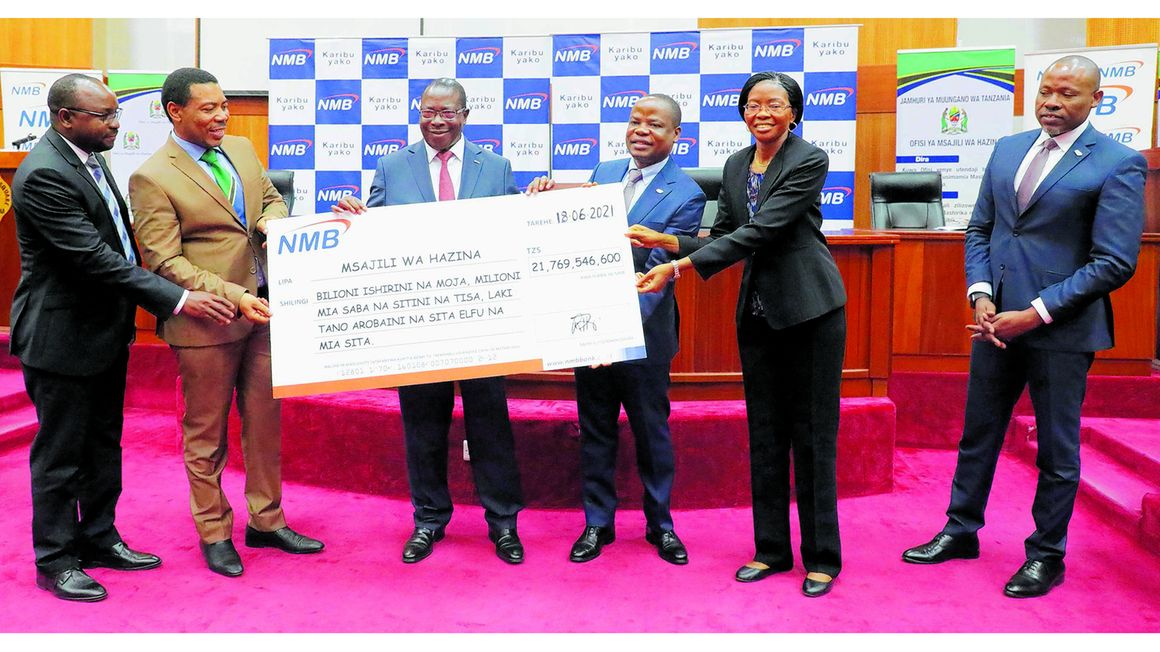

Vice President Phillip Mpango (3rd left) receives a check for Sh21.7 billion as dividend to the government from NMB Bank’s board chairman Edwin Mhede (3rd right) and chief executive officer Ruth Zaipuna (2nd right) in Dodoma yesterday. Others are Finance and Planning minister Mwigulu Nchemba (2nd left), Treasury Registrar Athumani Mbuttuka (left) and the bank’s chief finance officer, Juma Kimori (right). PHOTO | EDWIN MJWAHUZI

Dodoma. NMB Bank Plc yesterday issued Sh21.8 billion in dividend payout to the Treasury, bringing the total amount in dividend that the lender has paid out to the government to over Sh155.8 billion during the past 15 years.

Speaking before handing over the dummy cheque of the new payout in Dodoma to Vice President Philip Mpango, bank’s chief executive officer Ruth Zaipuna said NMB has already deposited the amount in national coffers ready for use and investment in development projects.

“NMB is one of the government’s privatized companies that has been making profits consistently for the past 15 years. NMB Bank, in this period has paid over Sh155.8 billion in dividend to the government,” the leading financial services provider in the country said in a statement.

Ms Zaipuna said the total dividend to the government for 2020 was a 43 per cent increase over what was remitted in the 2019 following the bank’s extraordinary performance during the year that set many in-house and sectoral records.

These, she explained, included a super net profit of Sh206 billion that also broke the previous NMB profit after tax record of Sh155 billion that had been set in 2014.

According to her, the increase in the dividend paid to the government was a clear indication of the bank’s ability and efficiency capacity to serve the country better, deliver value added benefits to shareholders and make a difference in people’s lives.

“In 2020, NMB Bank set an operational precedent in Tanzania’s banking sector after its net profit shot up by 45 per cent and reached Sh206 billion, compared to Sh142 billion attained in 2019, thereby setting a historic milestone in the banking sector in the country,” Ms Zaipuna noted in her speech.

She added that the bank did not clinch the number-one slot in profit making only during the year but also in various other competitive perimeters such as emerging tops in the size of the balance sheet that soared to Sh7 trillion.

NMB also led the pack in clients’ deposits with Sh5.3 trillion as its capital base also climbed to Sh1.1 trillion. Its operational efficiency was equally superb as it recorded an industry-best 51 per cent cost-to-income ratio.

On June 4, 2021, at the Annual General Meeting held online, NMB shareholders approved a total of Sh68.5 billion dividend payout, equivalent to Sh137 per share of which Sh21.8 billion has been paid to the Government for its 31.8 per cent stake in the business.

Other NMB shareholders have also been paid dividend, including Arise B.V, the largest shareholder who has received Sh23.9 billion from their 34.9 per cent shareholding.

“In addition to the dividend, NMB Bank paid over Sh245 billion to the government in 2020 as taxes ranging from Paye, Corporate Tax, Skills and Development Levy, Excise Duty and VAT on services,” Ms Zaipuna noted.

Speaking after receiving the hefty payout, Dr Mpango said NMB was indeed worth the investment the government made in the business since the economic value it was delivering goes beyond monetary value.

Citing the Sh1.4 billion the bank invested in social projects as part of its corporate social responsibility (CSR) activities, he called on other entities in which the government has shares to emulate the NMB case. However, Dr Mpango challenged the bank to deliver more value in the future since it has the financial muscle and innovative capacity to do so.

“NMB is leading by example, this is the third time I am receiving dividend from NMB Bank, two years while I was the Minister of Finance and Planning and the first time as the Vice President,” Dr Mpango said.

“If other entities did the same as NMB on dividend, we would witness a great improvement in the provision of social services for Tanzanians and contribute to the various strategic government projects in progress,” he added.

For his part, NMB Bank’s board chairman Edwin Mhede thanked the government for creating a conducive business environment through progressive fiscal and monetary policies that continue to make the bank profitable and enable it to deliver accordingly. He said the new dividend payout to the government reflects consistent delivery of strong returns to the bank’s shareholders and value-creation to stakeholders as NMB continues to transform lives.

No comments :

Post a Comment