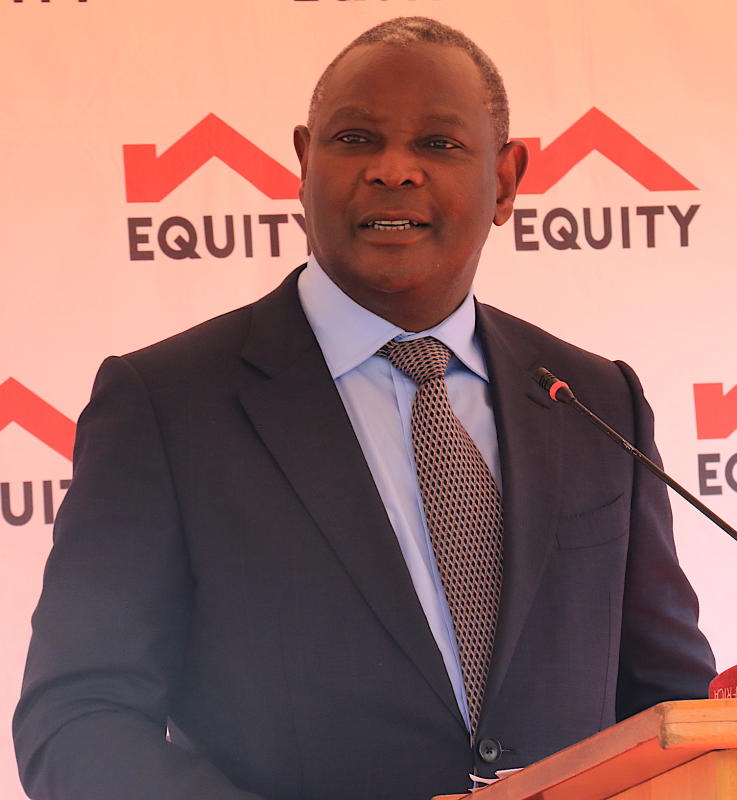

Equity Group MD and CEO Dr. James Mwangi [PHOTO: Wilberforce Okwiri, Standard]

Equity Group MD and CEO Dr. James Mwangi [PHOTO: Wilberforce Okwiri, Standard]

Equity Group Holdings has signed a Sh11 billion loan facility to support micro small and medium enterprises (MSMEs) during the coronavirus pandemic.

The deal was signed with Team Europe, Germany’s DEG, the Netherlands FMO and the UK’s CDC Group in Nairobi yesterday.

The lender has committed to loan repayment accommodation for up to 45 per cent of the customers whose cash flows and operation cycles were likely to be negatively impacted during the pandemic.

This is the fourth tranche for Equity Group, having signed a Sh5.5 billion loan facility with the International Finance Corporation in September last year and Sh11 billion from Proparco in October.

The lender signed another Sh16.5 billion loan facility last week with the European Investment Bank to fortify credit flows and liquidity to MSMEs.

This brings the total funding to Equity Group to Sh44 billion.

“We value our long-term partnership with DEG, FMO and CDC. The development banks recognise the critical role that Equity plays in promoting access to finance for MSMEs,” said Equity Group Chief Executive James Mwangi (pictured).

British High Commissioner to Kenya Jane Marriott said the UK is committed to delivering a strong, resilient economic recovery from Covid-19 in Kenya.

Through CDC, she noted, the UK’s support to Equity Bank will help Kenyan families and businesses to manage unexpected challenges and get back on their feet as soon as possible.

DEG Management Board Chief Executive Christiane Laibach said the funding will boost local SMEs’ liquidity.

“DEG is delighted to realise further financing for Equity Bank, together with our European partners CDC and FMO. Through our cooperation, we are contributing to supplying local SMEs with credit, which is key and in demand.”

No comments :

Post a Comment