Controller of Budget Dr Margaret Nyakang'o.

Controller of Budget Dr Margaret Nyakang'o.

Tax reliefs and the shutdown of businesses during the pandemic have severely dented the government’s revenue collection, a report by the Controller of Budget shows.

According to the National Government Budget Implementation Review report released this week, tax revenue declined by Sh35 billion to Sh317 billion between July and September compared to a similar period in 2019.

Last financial year, the Consolidated Fund received Sh352 billion in the first quarter.

“Tax contributed to the highest proportion of revenue into the Consolidated Fund, although it also recorded a decline by Sh35.38 billion compared to a similar period last year,” said Margaret Nyakang’o, the Controller of Budget, in the report.

“This decline is largely attributed to the adverse effects of the Covid-19 pandemic, which affected the business environment.”

The report comes a few weeks after the taxman revealed a shortfall in its tax collection target.

Kenya Revenue Authority (KRA) missed its target by Sh186.3 billion since March when the country reported its first case of Covid-19.

Githii Mburu, the KRA commissioner general said they collected Sh1.09 trillion against a target of Sh1.28 trillion in the eight months to November.

Cushion economy

Besides a tough business environment occasioned by the adverse effects of Covid-19, the shortfall was due to the tax waivers the government introduced to cushion the economy.

At the height of the pandemic in April, the government announced a reduction of five per cent on corporate income tax to 25 per cent while turnover tax levied on small businesses with revenues of less than Sh5 million was cut from three per cent to one per cent.

The State also reduced value added tax from 16 per cent to 14 per cent in a bid to make consumer goods affordable during the pandemic.

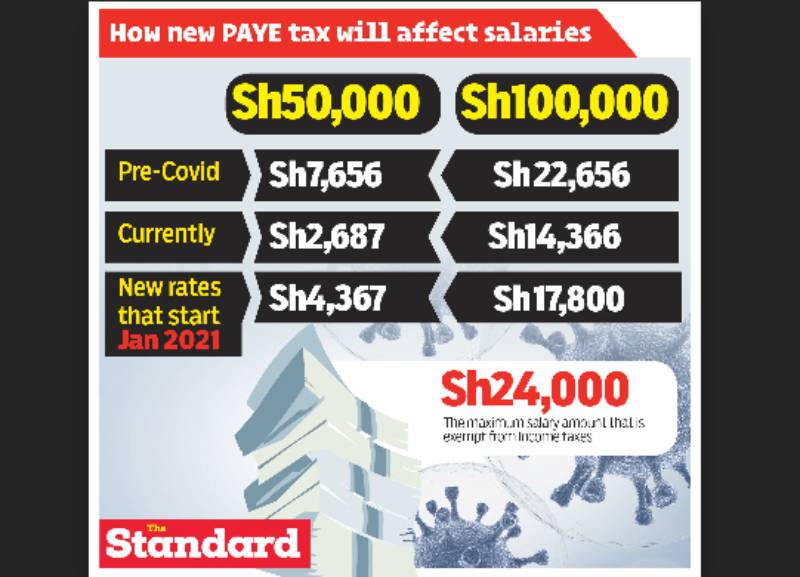

Workers earning Sh24,000 and below were exempted from Pay As You Earn tax.

But National Treasury Cabinet Secretary Ukur Yatani has said the tax waivers were no longer sustainable.

He said the decline in revenue will affect the implementation of the government’s priority programmes under the Big Four Agenda and the country’s economic recovery.

“Given the easing of some of the containment measures and subsequent resumption of normalcy, it has, therefore, become necessary to return to the pre-Covid-19 tax rates effective January 1, 2020,” he said.

Parliament on Tuesday passed a Bill to revert to the previous tax rates, and President Uhuru Kenyatta signed it into law on Wednesday.

Estimates show that the government will have foregone tax revenues amounting to Sh65 billion in the current financial year.

Treasury has argued that the resumption of the taxes will help government launch its post Covid-19 economic recovery.

President Kenyatta earlier this month announced a Sh930 billion economic recovery strategy.

This is not the first time, though, that tax holidays have affected the government’s revenue.

A report by KRA earlier this year showed that the country loses close to Sh500 billion annually from tax holidays.

iamohammed@standardmedia.co.ke

No comments :

Post a Comment