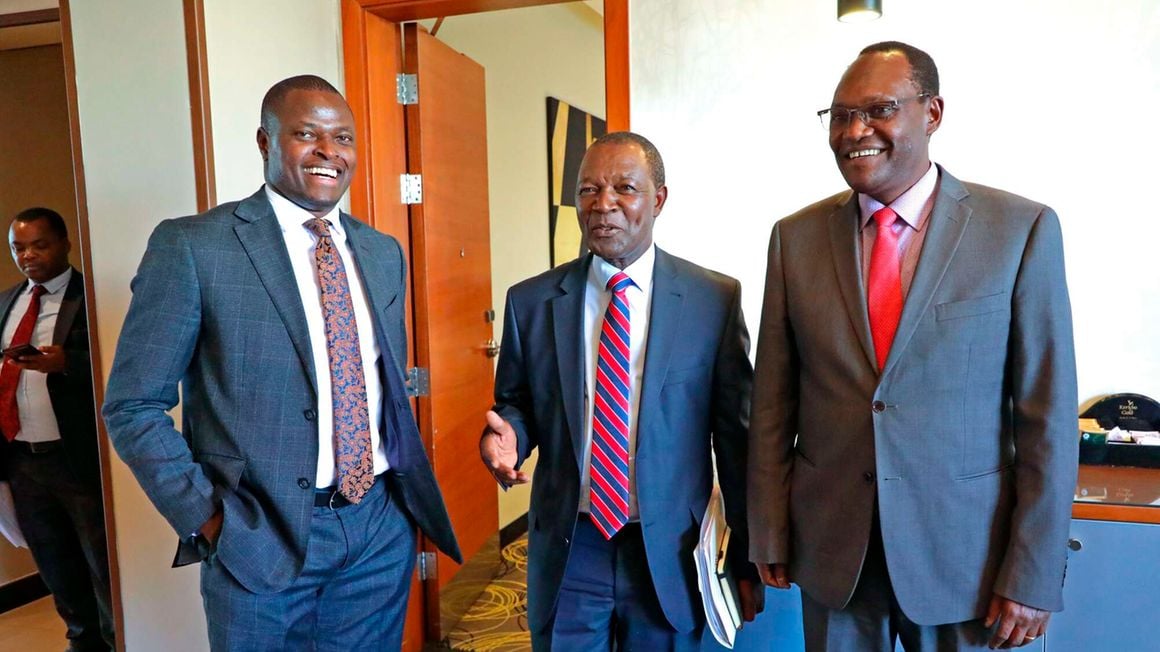

Budget and Appropriations Committee Chairperson Ndindi Nyoro (left), National Treasury and Economic Planning CS Njuguna Ndung’u (Centre) and Treasury PS Chris Kiptoo. FILE PHOTO | LUCY WANJIRU | NMG

The recent admission by Treasury CS, Njuguna Ndung'u that Kenya was facing a cash crunch is not very good news for the country. It is an admission that the Treasury is

yet to devise a winning formula for prudent management of public finances.One of the hallmarks of a country’s financial independence is its fiscal stability. Kenya’s tax policy is operationalised through the annual national budgets, which are financed from domestic and external resources. The Constitution of Kenya 2010, transferred the responsibility of budget-making from the National Treasury to the National Assembly.

Read: Use Sh100,000 pay data to fix tax gaps

Domestic revenues are obtained from taxes, domestic borrowing and appropriations-in-aid. Exchequer revenues comprise direct taxes (income tax and customs duty) and indirect taxes (VAT and Excise Tax). A good balance of direct and indirect taxes creates fiscal stability.

Kenya is currently facing a number of fiscal challenges. Firstly, an increase in prices of inputs leads to increased costs of production, which in turn leads to reduced output, price hikes, and sometimes closure of the enterprises altogether.

Secondly, the unpredictable number of payroll taxes puts a strain on enterprises’ financial planning. Thirdly, there is a wait-and-see posture of investors due to unpredictability in the investment environment, caused by frequent and uncoordinated tax policy changes. With reduced investments, the economy struggles to create jobs.

Corporate taxes significantly dry up when enterprises cannot produce to their full capacity. With rising taxes on inputs, production costs rise, leading to price spikes. Consumer welfare is adversely affected. Higher prices eat into consumers' disposable incomes, which translates to less consumption. Consequently, the government cannot collect enough consumption taxes such as VAT and excise. Equally disturbing is that Kenyans are not saving enough.

Typically, when savings increase, there is more liquidity in an economy, and interest rates fall. With reduced interest rates, investors can borrow more to invest. Unfortunately, the country is currently experiencing a unique situation where consumption, savings and investments are all on a downward trajectory.

To increase tax revenues without causing fiscal instability, governments normally target "sin goods” which include cigarettes, beer, wines and spirits whose demand doesn’t move proportionately with price changes.

One of the missteps of the current fiscal policy is to target goods that have substitutes. For example, if fuel prices spike, some motorists will opt for public transport, thus denying the government fuel levy. Domestic borrowing is preferred because it is relatively cheaper than external borrowing. It involves issuing sovereign instruments such as treasury bonds and bills.

The success of sovereign debts is hinged on sufficient liquidity to redeem them when they fall due. Similarly, development partners are reluctant to entrust a tax revenue-strapped economy with their funds. The options available are commercial and syndicated loans which are very expensive. The current revenue shortfalls are largely attributable to tax evasion and avoidance caused by the government’s high tax appetite.

Regarding tax administration, the KRA needs to engender a culture of collegiality at the board and management levels in order to benefit from synergy. To begin with, taxation is not an exact science. Effective tax administration depends to a large extent on the willingness of citizens to register, file returns, declare and pay their equitable taxes. To effectively manage this taxpayer compliance continuum requires partnership and confidence building between KRA and all the key stakeholders, something that cannot be achieved if the board and management work in silos.

The process also requires commitment at all levels of government. President Mwai Kibaki coined a tremendously successful slogan tulipe ushuru tujitegemee as a rallying call to Kenyans to guarantee their financial independence.

The tax authorities should seek to inculcate a positive taxpaying culture among Kenyans. Secondly, the government needs to tap into the existing institutional memory in order to facilitate KRA’s achievement of its mandate. The current situation at KRA is one in which both the chairman and commissioner general are in unfamiliar territory. To effectively mitigate this unfortunate situation, KRA requires trained and experienced revenue commissioners who can give correct advice to the commissioner general without feeling intimidated. This aspect needs to be looked into critically and objectively.

Read: Kenya races to meet World Bank's tax reforms target

Tax administration is a complex affair. It takes good technical training, experience and a revenue mindset to make an effective tax collector. These attributes are not found in lofty certificates from prestigious universities. They are obtained through training and diligent work in tax administration over a long period of time. Pundits have argued that the practice of deploying untrained personnel to undertake revenue administration functions is responsible for poor revenue performance.

Besides, the Treasury executives and their counterparts at the Times Tower should step down their elitism and seek pragmatic approaches that address the unique attributes and sensitivities of Kenya’s taxpayers.

Professor Ongore teaches at the Technical University of Kenya. He is a former senior KRA official.

vincent.ongore@tukenya.ac.ke

No comments :

Post a Comment