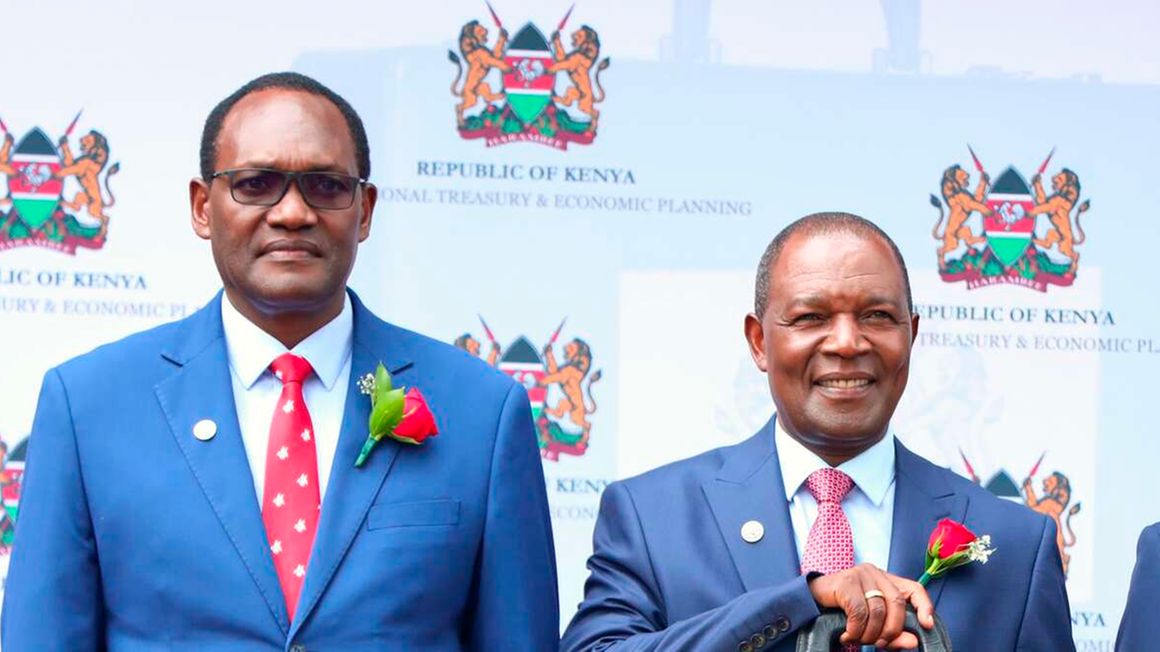

National Treasury and Economic Planning Cabinet Secretary Njuguna Ndung’u and his Treasury Principal Secretary Chris Kiptoo pose for a photo with a briefcase containing the 2023/2024 budget statement before proceeding to Parliament on June 15, 2023. PHOTO | LUCY WANJIRU | NMG

The Treasury has raised the domestic borrowing target for the current financial year by Sh50 billion, backpedalling on a previous cut effected in the first mini-budget released by the Kenya Kwanza administration.

The latest Estimates of Revenue, Grants and Loans for the financial year 2023/24 show the Treasury now targets Sh475.0 billion from the domestic market in the current financial year, up from the Sh425.1 billion prescribed in the Supplementary Budget I tabled earlier in the year.

Read: CBK boss warns of hurdles meeting borrowing target

In June 2022, the borrowing target for the current financial year, as prescribed by the Jubilee government, was set at Sh579.1 billion before Supplementary Budget I 2022/23, under the Ruto administration, revised it downward by 26.6 percent to Sh425.1 billion amid a push for aggressive fiscal consolidation by the new administration.

The latest revision comes on the back of receipts that were racing above the targets. The Treasury data shows as of May 31, actual receipts realised through domestic borrowing stood at Sh464.7 billion, implying it was already trending above the Supplementary Budget I target by Sh39.6 billion.

The upward revision in the domestic borrowing target comes as the government shifts its focus on domestic debt from the issuance of long-term instruments to more short and medium-term ones to align with investor appetite and realise the borrowing target for the period ending June 30

In June, the Treasury issued a record third tap sale on the three-year bond, FXD1/2023/03, which has, so far, raised Sh76.7 billion against the targeted Sh65.0 billion.

On June 15, Treasury PS Chris Kiptoo told the Business Daily that the oversubscription of the June 2023 infrastructure bond had seen the State realise its domestic borrowing target. The June 2023 infrastructure bond attracted bids worth a staggering Sh220.5 billion against the targeted Sh60 billion.

“We have done well on the external front, we were able to get the money we targeted through the Syndicated loan, the World Bank and the IMF (International Monetary Fund). So, we have done well on the external but on the domestic, we have struggled and it was really a challenge. However, in the last performance, because we came up with an attractive infrastructure bond, we were looking for Sh60 billion yet got Sh213 billion which we have taken.”

The upward revision also comes at a time when the latest revenue mobilisation data shows with only one month before the close of the financial year, tax revenue collected was short of its target by Sh367.9 billion, with the Treasury expressing bullish prospects -- that while the taxman might not realise its target tax revenue collection for the current financial year, it will still perform reasonably well.

“KRA has not been performing well. Overall, however, we expect a final push and pick up before the end of the year such that we may not end up with a 100 percent performance rate, but I think it will be a final good push,” said Dr Kiptoo.

President William Ruto assented to Supplementary Budget II 2022/23 on Monday, paving the way for an additional Sh22.9 billion from the Consolidated Fund.

Read: CBK leans on 3-year bond to boost domestic borrowing

The initial budget had been set at Sh1.57 trillion in June 2022 before being revised downward to Sh1.55 trillion through Supplementary I 2022/23.

The allocation has now been revised upward to Sh1.58 trillion through Supplementary Budget II 2022/23.

→ jamboko@ke.nationmedia.com

No comments :

Post a Comment