The Nairobi Securities Exchange (NSE) is showing signs of ending a painful market rout driven by foreign investor exits chasing after better returns from...

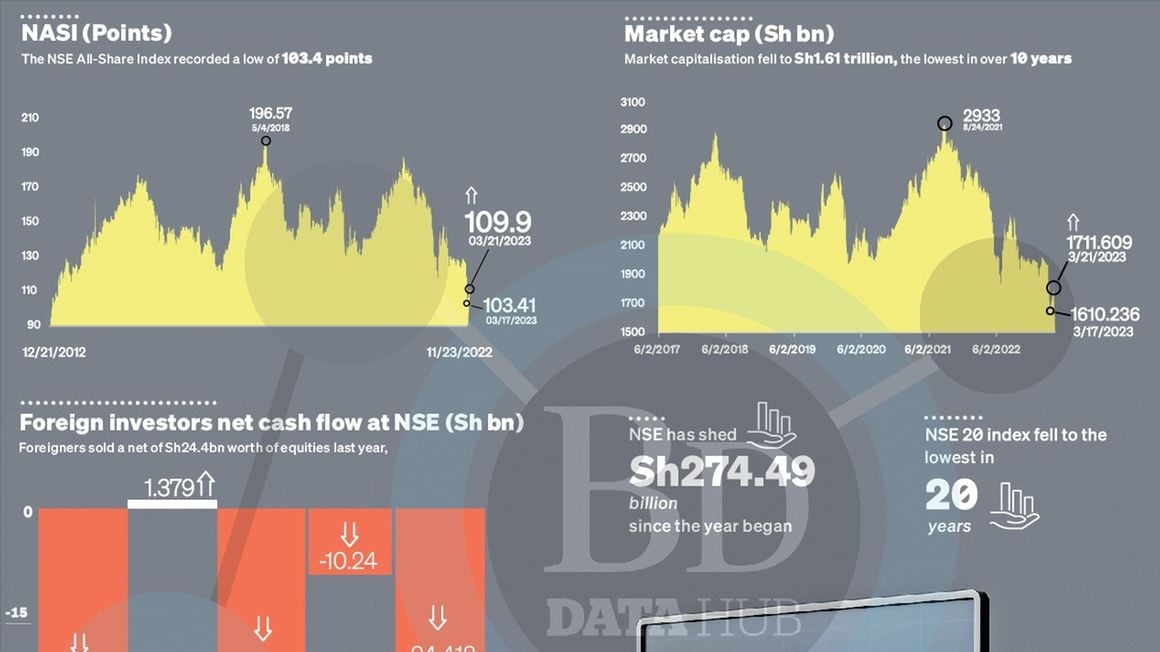

western government securities.The NSE All-Share Index (NASI), a market capitalisation-weighted index which was introduced in 2008, is now recovering from an 11-year low, having recorded 109.9 points at the close of trading Tuesday trading from 103.41 points last week.

Market capitalisation — the total valuation of all equities at the bourse — dropped to Sh1.61 trillion, the lowest since May 2013, meaning investors had shed Sh373.8 billion since the year began.

Dollar scarcity and low returns from equities compared to other asset classes such as government securities have hurt market performance since the beginning of last year, but there have been notable gains since the week began.

But analysts remain cagey about the recovery of the bourse, saying that while equities might hold they are not likely to hit the Sh2 trillion mark soon.

“Local and few offshore buyers took advantage to mop up Safaricom shares during the slump. The demand propped up the price and as a result, the indices and market capitalisation have gained,” said Kenneth Minjire, Senior Associate Debt & Equities AIB.

The bear run that has hit stock markets globally has been attributed to rate hikes in the US and the scarcity of dollars that has seen weaker currencies struggle against the greenback.

“The Kenyan market is largely intertwined with global markets and it relies heavily on global capital. But as it stands, companies’ fundamentals are looking okay with major shareholders showing confidence in the companies,” said Eric Musau, the executive director of research at SIB.

“If the Fed rate is hiked by more than 25 basis points it is likely to hurt the Kenyan stock market, but we can’t say with certainty if the worst is behind us,” added Mr Musau.

Safaricom, which once accounted for 61 percent of the total bourse value, has seen its value fall 58 percent from Sh1.8 trillion in August 2021 to Sh759 billion on Tuesday.

Further analysis shows that 28 out of the 59 actively trading counters at the NSE have shed more than a quarter of their value compared to their 52-week high.

Car & General (60.5 percent), Unga Group (54.2 percent) and Sameer (52.2 percent) have shed the biggest value compared to the highest value they attained in the last year.

→ tnyabera@ke.nationmedia.com

No comments :

Post a Comment