FOREX is gaining demand among individuals, SMEs, and Corporates seeking to import and export goods and services, send money to loved ones abroad or invest.

The Foreign Exchange Market, which is one of the largest international financial markets, has continued to evolve over the years, with financial institutions adopting innovative solutions that give consumers the power to monitor and view current exchange rates and book conversions anytime, anywhere.

These solutions come with the added benefit of being available outside business hours, allowing customers to carry out their transactions at a time that is convenient for them.

Forex solutions

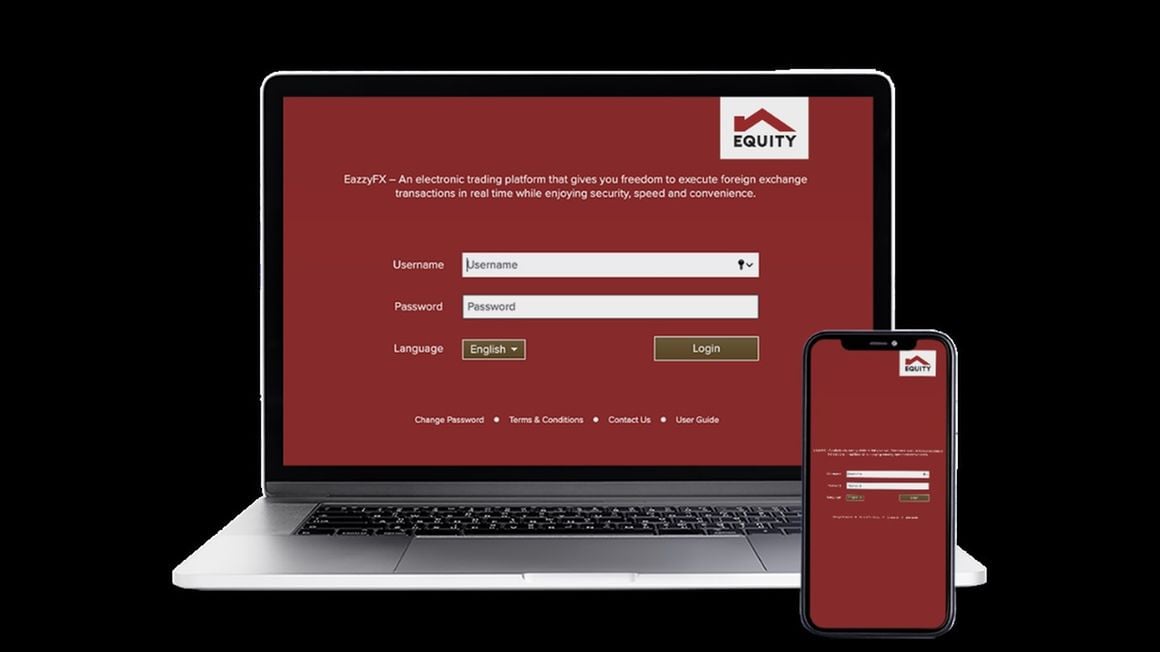

Equity, for instance, has upgraded its EazzyFX platform to provide automated FX prices, in its quest to offer customers convenience and facilitate cross-border trade and payments. Customers can now enjoy real-time and secure FX trade from wherever they are without calling or visiting Equity Bank branches to negotiate rates.

The platform offers competitive market pricing to enable customers to settle their foreign exchange transactions. Other key features of the platform include viewing real-time streamed rates through a single click with no additional cost, immediately tailored request-for-quotation for any FX trade amount, placement of multiple trade orders, and access to the history of the executed FX transactions.

Users are able to personalise their profiles detailing their preferred currency pairs from the main dashboard in order to monitor a specific currency or to compare particular currencies against others.

Equity understands that there are certain risks that arise from fluctuating foreign currencies exchange rates, and therefore offers risk management solutions such as FX forward contracts, FX options, and FX swaps, to enable businesses to operate more efficiently and with the certainty of rates applied upon maturity.

To execute this, customers can enter into contractual agreements to transact at a future date, and at an agreed exchange rate and amount.

EazzyFX offers an improved alternative to the selection of trading platforms currently available in the market. The platform enables users to transact more efficiently and transparently since real-time prices are displayed.

On the other hand, the Bank will use the data and other analytics tools to make appropriate trade decisions with a view of giving clients value for money.

Savings and investment solutions

Additionally, the Bank, through its treasury solutions, presents investment opportunities within the local and international markets, such as Eurobonds, Treasury bills, and Treasury bonds, giving clients a variety of options in matters of investment.

For short-term investment products, the Bank offers very competitive rates on its call and fixed deposit accounts (KES & USD), with customers having the flexibility to choose their tenor as well as the currency of their placements in line with their liquidity management needs.

Looking into the future, there’s a need for financial institutions to continue developing innovative solutions that are focused on meeting the evolving needs of their unique customer segments.

Equity is leveraging its digital solutions to drive efficiency, and offer customers the freedom to transact in real time while enjoying security and convenience. To sign up for EazzyFX, customers can visit https://equitygroupholdings.com/ke/EazzyFX, or call: +254 763 000 000, or visit any Equity branch near them for support.

No comments :

Post a Comment