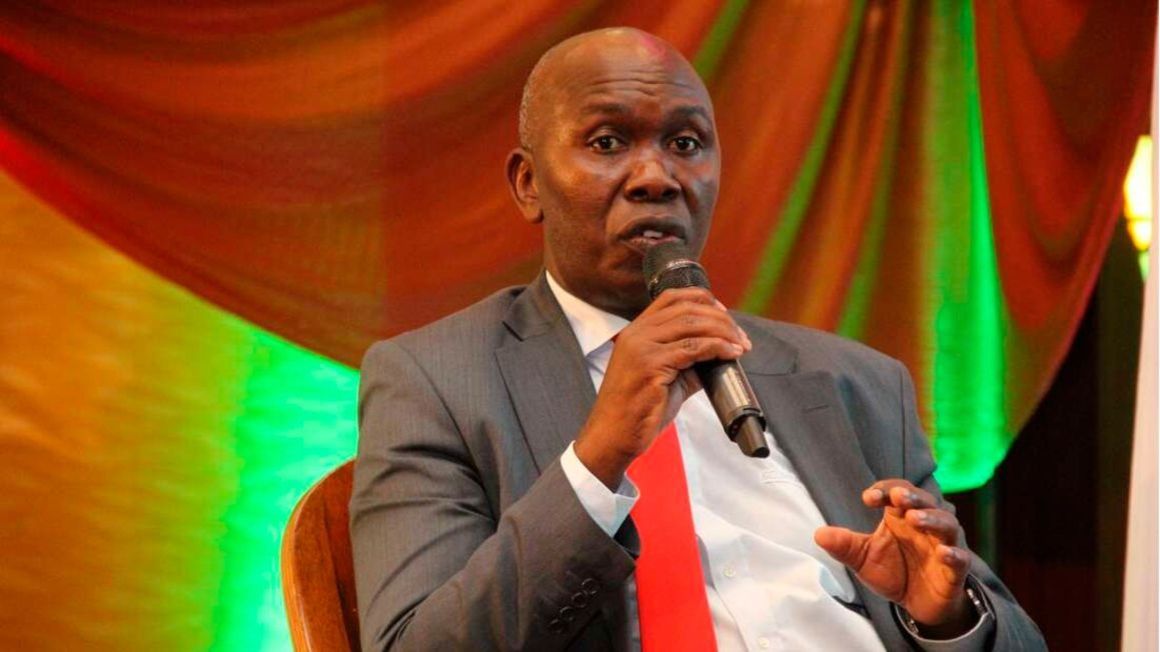

Capital Markets Authority (CMA) CEO Wyckliffe Shamiah on April 29, 2021. PHOTO | LUCY WANJIRU | NMG

Collective investment schemes have cut funds invested in property by 58.1 percent following a regulatory requirement that they exit the asset class which locks capital for years.

Investment in immovable property in the quarter to March dropped to Sh215.78 million –the smallest allocation among the various asset classes— from Sh515.4 million in December 2021 according to data from the Capital Markets Authority (CMA).

The regulator in 2020 issued guidelines to the schemes restricting them to invest in assets with a maximum duration of 13 months.

The directive is aimed at enhancing liquidity and lowering risk among the schemes whose client base is mostly comprised of individuals.

The regulations have led to a shift to more liquid assets. The CMA data show the pooled funds raised their investment in government securities by 7.4 percent to Sh64.1 billion.

Allocations to bank fixed deposits meanwhile grew marginally to Sh60.8 billion.

Land and buildings take longer to buy and sell compared to fixed deposits and marketable securities like T-bills. An investment property also requires larger amounts of capital, with most modern buildings selling for hundreds of millions of shillings.

In addition, real estate assets can sell at a significantly different price –upwards or downwards— from the cost of the purchase which makes it difficult to value them.

The guidelines targeting valuation, reporting, and performance measurement in the schemes came into effect on January 1 last year.

They were intended to improve transparency in the sector and help investors compare the performance of different funds.

Investments of less than 13 months would include Treasury bills and bank deposits and short-term government bonds.

ekivuva@ke.nationmedia.com

No comments :

Post a Comment