By Jonia Kashalaba

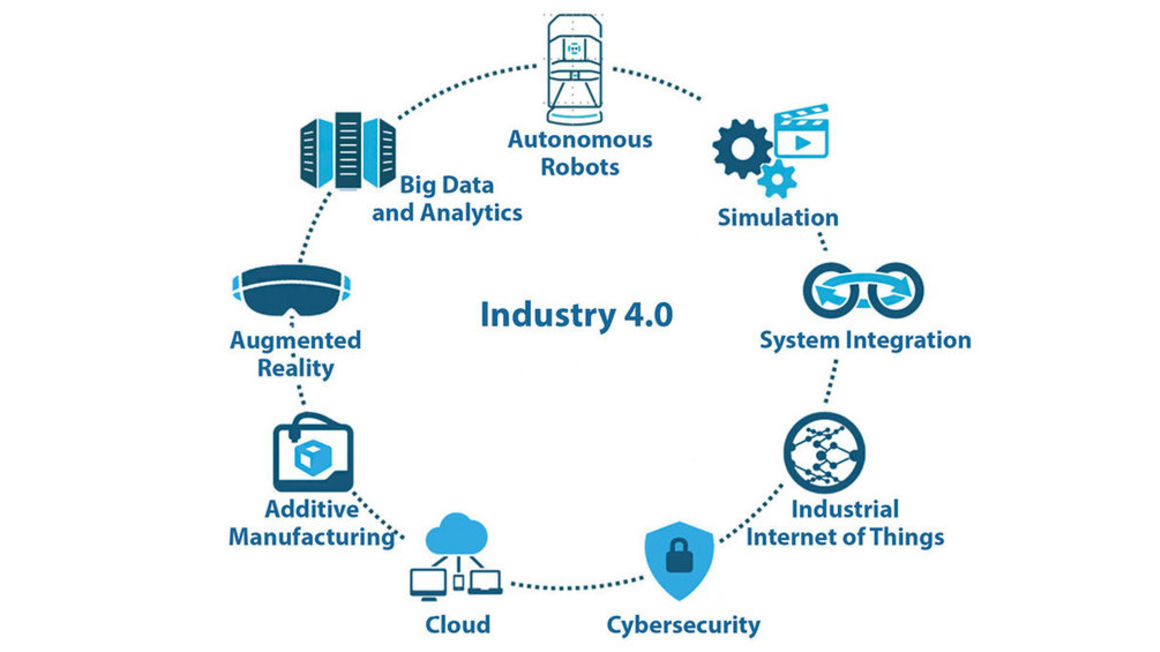

In May 2021 during “Innovation Week” technology experts highlighted the potential for the

Fourth Industrial Revolution (Industry 4.0) to drive Tanzania’s development.A month later the Finance Act 2021 introduced a requirement (to take effect from 1 July 2022) for a taxpayer who maintains documents in electronic form to maintain a “primary data server” in Tanzania.

It defined the term “primary data server” to mean “a server that stores data that is created or collected by a taxable person or liable person in the ordinary course of business”, but did not define the term “data”.

This impending imposition on Tanzanian businesses of this requirement for a local physical primary data server would run against current technology trends, and in particular the move to cloud based storage systems that are more secure, convenient, environmentally friendly and cost efficient. Indeed, it begs the question: do we really want to “walk the talk” of Industry 4.0?

This unexpected change brought to mind a 2018 thought leadership piece by Jumanne Mtambalike (the CEO of Sahara Ventures). “Can Tanzania leapfrog to the fourth industrial revolution?” was the title, and his response was:

“The simple answer is yes, but only if we embrace the advancement of science and technology. As we are living in the industrialization era we can not afford to start from where others have left 50 years ago. We have to move at the same pace as our global counterparts.”

Globally, I have yet to identify the imposition of a similar primary data server requirement such as Tanzania’s. Many countries have imposed requirements in relation to data protection laws to regulate the collection and processing of the data of private individuals, but that is something separate.

Why the change? The statement of reasons in the Finance Bill 2021 explained the motive as being to enable “effective accessibility of information”.

The objective then is to ensure that TRA have access to data or any information needed in the process of collecting Government revenue. However, this presupposes that cloud systems are synonymous with lack of access.

I would beg to differ as there are ways to interrogate cloud systems and download data from such systems - and ideally the legislative amendment should have focussed on this aspect.

Tanzania appears to be unique (certainly in East Africa and Africa more broadly) in proposing this requirement to maintain a physical primary data server in-country. For example, no such requirement (for tax purposes) applies in Kenya or Uganda, which begs the question if they can manage without the imposition of such a requirement, then why can’t we? Of concern is that the introduction of such a requirement will have competitive implications for Tanzania - not least because of increased costs given the need for investment in hardware and supporting infrastructure, office space for the hardware, IT personnel.

The concern is both for local businesses (if this requirement precludes the adoption of the most cost effective technologies) and for regional organisations potentially looking to make Tanzania a regional hub (but using cloud platforms). Indeed, this requirement could stymie Tanzania’s aspiration to be a regional ICT hub.

So what should be done? Well, if this requirement is at all to be maintained then it would be best restricted to certain regulated businesses (such as telecoms, banks, insurances, etc.) whose existing industry regulatory requirements already impose such a requirement. If the concern is timely access to data for TRA, then I believe that there are appropriate technology mechanisms that can be agreed with businesses to ensure such access on a timely basis, and this could be dealt with in regulations. Certainly, the policy makers should liaise with other jurisdictions to see what they do in this space.

In the meantime, ideally this requirement should be removed pending a review by policy makers as to the best solution to accessing data from businesses. From discussions with my clients, I understand that this is a major issue to most businesses and that a request for removal of the requirement is among the proposals submitted by many to the Ministry of Finance and Planning in the 2022/23 pre-budget tax reform proposals. Hopefully we will see an appropriate change announced in the budget speech in June.

Jonia Kashalaba (jonia.k@pwc.com) is a Senior Manager, Tax Services with PwC Tanzania.

No comments :

Post a Comment