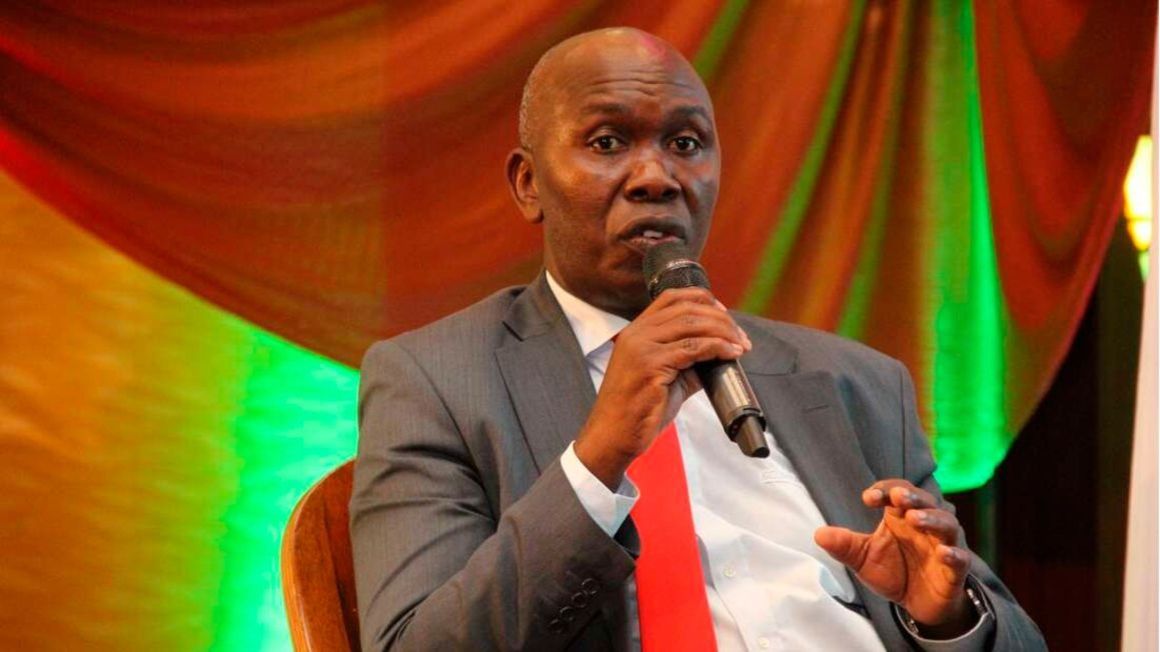

Capital Markets Authority (CMA) CEO Wyckliffe Shamiah on April 29, 2021. PHOTO | LUCY WANJIRU | NMG

The Capital Markets Authority (CMA) plans to relax rules guiding the listing of companies as a means of encouraging more firms to go public.

The last listing on the Nairobi Securities Exchange was in December 2020 when HomeBoyz Entertainment, a small business, went public by introduction (without selling shares).

The last initial public offering (IPO) was in 2015 when property investment fund ILAM Fahari I-Reit raised Sh3.6 billion.

The regulator says it has received feedback from market participants that the existing Public Offers Listing and Disclosure Regulations, 2002 are a major barrier to new listings.

The regulations require a company to have posted profits in the three years before going public besides ceding at least a quarter of its shares to at least 1,000 shareholders who are not its employees.

“As a result, the authority has embarked on a complete overhaul of the existing regulations in a bid to address some of the key challenges and gaps identified by stakeholders,” said the CMA in its latest Market Soundness report.

“The new regulations seek to ensure that there is regulatory clarity for issuers, questions relating to high costs of public offering are addressed, provision of a flexible regulatory environment that is pro-innovation.”

The regulator added that it is also expanding the provision for an IPO to include special purpose acquisition companies (SPACs).

A SPAC is a publicly-traded corporation with a two-year life span formed with the sole purpose of effecting a merger with a privately held business to enable it to go public.

SPACs raise money largely from public-equity investors and have the potential to derisk and shorten the IPO process for their target companies, often offering them better terms than a traditional IPO would.

“Additionally, we are expanding provision for initial public offerings to include SPAC IPOs as we seek to limit the time it takes to come to market for companies that opt to use this capital raising option,” said the CMA.

SPACs have lower charges — two percent as underwriter fees and 3.5 percent completion fees — compared to at least five percent to seven percent additional costs including legal, audit, registration and administrative expenses for normal IPO listing.

The listing timeline is shorter and the valuation is based on negotiation between the target company and the SPAC sponsor.

ekivuva@ke.nationmedia.com

No comments :

Post a Comment