One of the plans directly concerns the village community banks (Vicoba) system, which was first introduced in Zanzibar in 2001 basically “to increase incomes and reduce poverty among widows...”

In due course of time and events, the Vicoba system spread over to, and across, Mainland Tanzania, mainly supported by such socioeconomic development partners as CARE Tanzania; World Conference on Religion and Peace (WCRP/TZ); the LAMP Prtogramme; the DDP Programme; SIDA; Frankfurt Zoological Society of Tanzania, etc.

The Vicoba scheme has been educating its member groups on capacity building and local resources mobilisation; self-help initiatives, community ownership and shared leadership; voluntary accountability and general good governance.

Now, the National Economic Empowerment Council (NEEC) has teamed up with Sanlam General Insurance Company (Sanlam) to launch an insurance scheme that is specially designed for the Vicoba system in Tanzania.

Working in close association with Tira, the NEEC/Sanlam team is working on a scheme which is intended to bolster active participation by Vicoba (and similar groups) in the country’s financial sector as well. Also working as the coordinator of the scheme, the Empowerment Council (NEEC) will link and otherwise bring Vicoba member groups closer to the growth opportunities in the Insurance industry.

Agreeing with the foregoing, the Sanlam chief executive, Geoffrey Masige, said the threesome partnership of NEEC, Tira and Sanlam is a positive step “in empowering small entrepreneurs in the informal market to access insurance products and services.”

How true, we say, as this is bound to ramp up the Vicoba lending and other capacities to its enterprising, venturesome members.

NO SUCH THING AS FREE MONEY

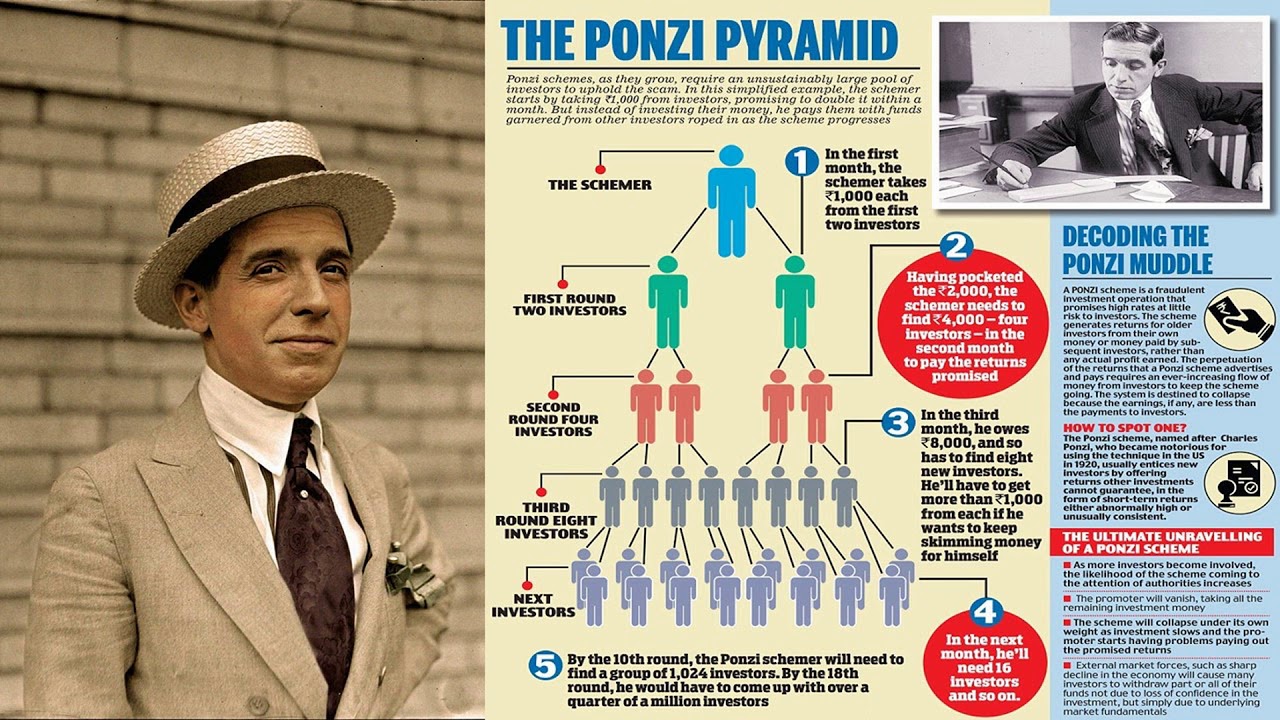

Will people ever learn? That is the question which inevitably comes to the fore following reports that about 40,000 people have been conned out of billions of shillings in what was essentially a Ponzi scheme in Kilimanjaro Region.

The scam is under investigation, but this is little consolation to those who lost their hard-earned money to the tricksters behind the scheme since it is rare for victims in such frauds to recover all the cash they “invested”.

In developing countries such as Tanzania, where awareness of Ponzi schemes and similar frauds is still low, people tend to be drawn to dubious money schemes like moths are attracted to light. The main incentive is quick and unrealistically high returns to the first investors from money invested by later investors.

However, what most people are ignorant of is the fact that Ponzi schemes by their very nature are not sustainable, and are bound to collapse at some point or another, with the loss of investors’ money.

Tanzanians need to know that there is no such thing as free money, which is essentially what Ponzi schemes promise. When the offer is too good to be true, one should simply walk away. It could save them a lot of grief in the end.

No comments :

Post a Comment