The Dow Jones Industrial Average plunged by 1.3%, closing with 30,223.89 and dropping about 700 index points at one point.

U.S stocks ended the first trading session of 2021 on a bearish note amid concerns about global COVID-19 cases and the Georgia senate runoff elections in play at the world’s largest economy.

What you must know: It was the biggest one-day sell-off since October 28 for the Dow (which comprises the most capitalized stocks in U.S Stock Exchange) and S&P 500, while the Nasdaq had its worst daily performance since December. 9.

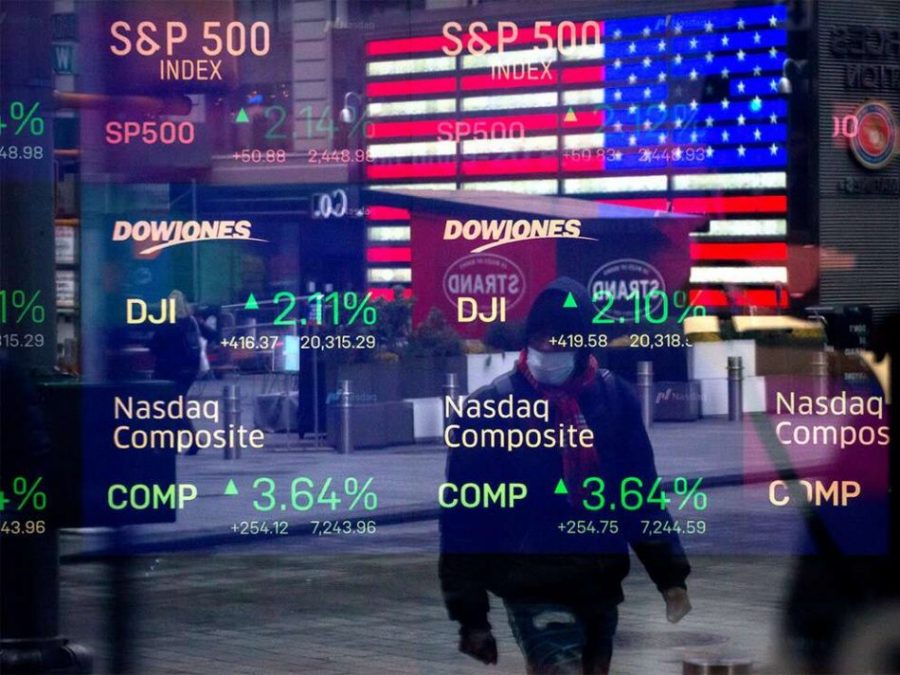

- The Dow Jones Industrial Average plunged by 1.3%, closing with 30,223.89. At one point, the Dow dropped about 700 index points. Monday marked the first negative start to a year for the Dow since 2016.

- The S&P 500 lost about 1.5% to 3,700.65.

- The Nasdaq Composite also dropped 1.5%, ending the day at 12,698.45. Both the Dow and S&P 500 hit record highs at the open before turning lower.

Stephen Innes, Chief Global Market Strategist at Axi, in a note to Nairametrics, spoke on macros weighing hard on investors minds:

“Despite investors galloping out of the gates to face a brave new year, it was the same old lockdown fear that saw investors recoil as buyer beware set in.

“While the big macro recovery and rotation view may be the “ultimate trade for 2021,” the “January trade” could be very different as the near-term landscape got a whole lot more dangerous looking very quickly.

“Markets have treated recent lockdowns more as speed bumps than hitting a brick wall at full speed.”

What to expect: However, the Georgia Senate runoff complicates matters as the street does not know how to trade or invest it. While it seems reasonable to assume that the status quo will see most post-election trades pull through, the balance of uncertainty lies in a Democratic sweep, especially if bond yields go higher.

No comments :

Post a Comment