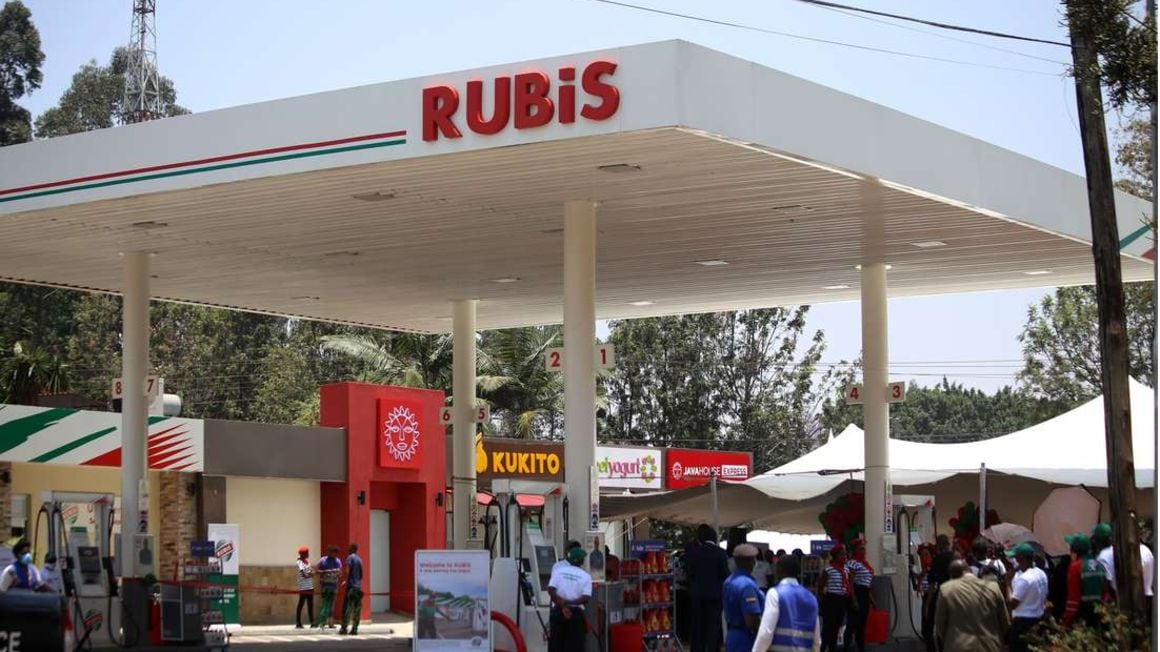

Rubis Gigiri, Nairobi. FILE PHOTO | NMG

Summary

- Recent rebrands in Kenya that have followed mergers and acquisitions include Barclays Kenya to Absa Kenya, KenolKobil/Gulf Energy to Rubis Énergie, Jamii Bora to Kingdom Bank, Transnational to Access Bank Kenya and NIC/CBA to NCBA.

- Rubis Energy Kenya managing director Jean-Christian Bergeron said their rebrand was informed by a study that shows that their customers preferred the companies shift to Rubis as it had an international appeal.

- Initially, the firm had indicated that it was willing to retain the KenolKobil brand name in the Kenya market.

It is normal for a company to tweak its brand to drive business and reinvigorate presence.

Companies may want to develop new logos, marketing materials as well as names to rejuvenate interest from consumers, employees and investors, as well as stay ahead of competitors.

Recent rebrands in Kenya that have followed mergers and acquisitions include Barclays Kenya to Absa Kenya, KenolKobil/Gulf Energy to Rubis Énergie, Jamii Bora to Kingdom Bank, Transnational to Access Bank Kenya and NIC/CBA to NCBA.

Rubis Energy Kenya managing director Jean-Christian Bergeron said their rebrand was informed by a study that shows that their customers preferred the companies shift to Rubis as it had an international appeal.

Initially, the firm had indicated that it was willing to retain the KenolKobil brand name in the Kenya market.

“They responded that Rubis-as an international brand-would match their expectations and requirements,” said Mr Bergeron.

Rubis goes on buyout spree

Rubis Énergie also acquired Gulf through KenolKobil – its first subsidiary in the Kenyan market — which it had bought earlier at a cost of $353 million (Sh38.3 billion).

To attract new customers as well as retain existing ones, Mr Bergeron revealed that they would put up French Brioche Café Bistros at their service stations nationwide that will offer customers a value add when they are fuelling their vehicles.

“We are also introducing Good African Coffee, a company which supports independent coffee farmers, thus ensuring that coffee is bought at a sustainable price,” he adds.

“We are about to introduce many other offers and services, such as making sunglasses and reading glasses available in our service stations through a partnership with Essilor.”

Brand Extreme Kenya lead creative Samuel Gitau said businesses and organisations may want to rebrand to create a fresh appeal to the market as well as target new audiences in order to avoid being left behind in a fast evolving market where new investors are coming into every sector every year.

"In these dynamic modern times, current and potential customers’ needs keep evolving. Brands need to stay current and adapt or risk being left behind," Mr Gitau advised.

"New ownership, mergers and acquisitions will also more often be followed by a rebrand. In some instances, a public relations crisis may also be overcome by a rebrand.”

Jubilee eyes global market

He added that a rebrand may also follow a change in a company’s strategy, introduction of new products and/or services, differentiation from competition, and internationalisation and modernisation of an old image.

When Jubilee Holdings in September sold a stake in its regional general insurance subsidiaries to German conglomerate Allianz SE for a total of Sh10.8 billion, it moved to incorporate the Allianz brand in the name of the units.

The deal will see the new unit in which Allianz is buying a stake operate as Jubilee Allianz General Insurance company, signalling that the two firms will leverage on each other’s existing strengths.

“We also want our current products to catch up with what is offered in markets such as Europe and North America. We think Allianz will give us the support,” Jubilee Holdings chairman Nizar Juma said earlier in an interview.

Mr Gitau added that a rebrand benefits a business in capturing the attention of new customers and penetrating new markets, gaining a competitive edge and improved brand awareness and loyalty.

"A refreshed brand will inject a new lease of life into a company’s visual identity; and reflect novelty and progress. Internally, it inspires a renewed sense of energy and purpose,” he said.

Absa refocuses

Absa head office in Westlands, Nairobi. FILE PHOTO | NMG

Similarly, in February 2020, Barclays Kenya rebranded to Absa to focus on the African financial market. This after British bank Barclays sold most of its controlling stake in Absa, South Africa’s third-largest lender.

Barclays had acquired a majority stake in Absa in 2005, but reduced its shareholding in 2017 from 62 percent to 15 percent by selling shares to large investors, including South Africa’s Public Investment Corporation.

In 2019, the Competition Authority of Kenya (CAK) approved a merger between Commercial Bank of Africa (CBA) and NIC Group Plc, resulting in the two banks rebranding as NCBA, which started trading as a single brand.

Speaking after the rebrand, NCBA Group managing director John Gachora said the merger would enable them to support larger corporates, a market segment that for a long time has been dominated by foreign financial institutions.

The two lenders had also built their own strong brands, which made it hard for them to settle on either to carry the merged unit, hence the need for a rebrand.

Two other bank takeovers in recent months have also resulted in a rebrand.

In August 2020, Cooperative bank rebranded Jamii Bora Bank as Kingdom Bank after completing the acquisition of a 90 percent stake in the small lender in a deal worth Sh1 billion.

Kingdom Bank on SMEs

Kingdom Bank. FILE PHOTO | NMG

Two months after the Jamii Bora rebrand, Nigerian lender Access Bank followed suit with its own rebrand of Transnational Bank, in which it had acquired a majority 99.98 percent stake in July for Sh1.58 billion from companies owned by close associates of the late President Daniel arap Moi.

Both of these rebrands were part of a wider shift in strategic direction for the two acquired lenders, with the larger new owners.

Tier-one Cooperative Bank said after the move that it would use the new subsidiary to deepen micro-small and medium-sized entities banking, microfinance, youth and women banking, asset finance and leasing.

Access Bank plans to use the Transnational acquisition as a means of entering the Kenyan market, as part of a wider plan to expand its footprint in the African continent.

Renaming the acquisition serves to bring visibility to its brand. The bank announced that it would follow up with an expansion drive, which would see it go into 21 counties from the current 12 that are served by 24 branches.

Strategically, Transnational was strong on agribusiness financing prior to the buyout, with the Nigerian lender planning to grow into new areas such as trade financing, SME lending and corporate banking.

The changes did not stop with the rebrands for both Jamii Bora and Transnational however, with their new owners ringing in the changes in top management. New CEOs have been installed and new board members brought in, complete with a change of chairmen.

No comments :

Post a Comment