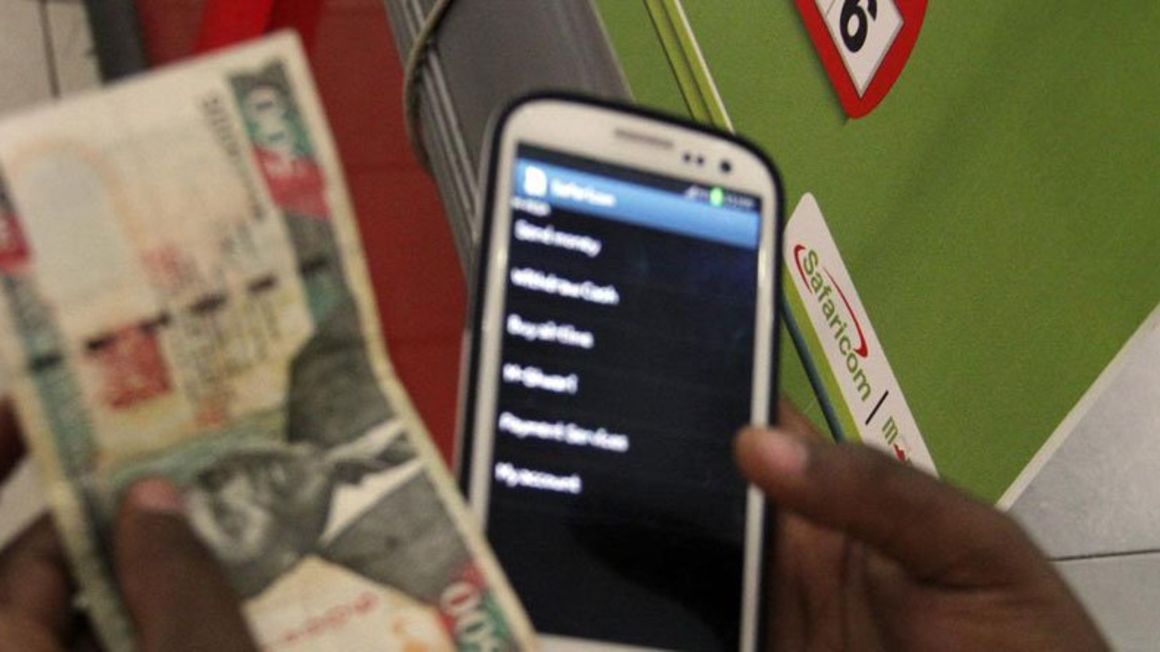

Small and medium private hospitals using M-Pesa and M-Tiba pay-platforms can now acquire medical equipment on loan from GE Healthcare. file photo | nmg

Summary

- Government payments are increasingly becoming contactless (and more mobile), which is an encouraging trend.

- The Communications Authority of Kenya data shows that person-to-government (P2G) payments more than doubled in the first quarter of 2020 to Sh23 billion.

- Total tax payments through mobile platforms stood at Sh21 billion during the financial year 2018/19.

Government payments are increasingly becoming contactless (and more mobile), which is an encouraging trend.

The Communications Authority of Kenya data shows that person-to-government (P2G) payments more than doubled in the first quarter of 2020 to Sh23 billion. Total tax payments through mobile platforms stood at Sh21 billion during the financial year 2018/19.

In the larger scheme of mobile payments, these are a drop in the ocean. Nonetheless, it points to the fact that the future of government payments is mobile. State agencies must now think mobile when it comes to payments. And several initiatives will contribute to this realisation. The government has created a one-stop portal for services known as e-Citizen where citizens, both in-country and overseas, can access such services as passport application, civil registration, police services and birth certificate registration, among others. Users can use card payments or mobile payments, mostly M-Pesa.

Government-to-person payments (G2P) offers a big opportunity to go mobile. Specifically, social welfare payments. If effected, disbursements through the mobile wallets can be the largest execution of mobile payments. The government has developed and implemented different schemes and interventions in the social protection sector. These include the Kenya National Safety Net Programme since 2013.

The social protection initiative sought to provide a common operating framework for the government's five cash transfer programmes namely Persons with Severe Disabilities Cash Transfer, Older Persons Cash Transfer, Cash Transfer for Orphans and Vulnerable Children Cash and the Hunger Safety Net Cash Transfer. According to the fiscal year 2015/16 statistics, about 120,000 households received direct social support. The government spends about Sh13 billion on these programmes annually. However, payments are made directly to the beneficiaries through financial institutions — KCB and Equity Bank — ostensibly because they have a large branch network.

There is an opportunity for the government to make direct payments through beneficiary mobile wallets.

The only attempt for the government to implement direct transfers to beneficiary mobile wallets is through the Covid-19 pandemic relief support to vulnerable families where the government had disclosed plans to spend some Sh10 billion through direct transfers to the families.

The private sector has ready solutions. In fact, when it comes to person-to-government (or P2G) payments, products such as mVisa can help government agencies accelerate the adoption of mobile payments.

No comments :

Post a Comment