The worldwide smartphone market showed signs of improvement in the third quarter of 2020 with shipments declining just 1.3 per cent year over year, according to preliminary data from the

International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.In total, 353.6 million smartphones were shipped during the third quarter and while the market declined, the results were stronger than IDC's previous forecast of a 9 per cent year-over-year decline.

This is largely attributed to the re-opening of economies around the globe as COVID-19 restrictions were gradually relaxed.

An important trend on the road to market recovery is a faster than expected rebound in some key emerging markets.

India, which is the second-largest market globally, witnessed strong volumes during the quarter despite further concerns around the COVID pandemic. Other emerging markets, such as Brazil, Indonesia, and Russia, which rank fourth, fifth, and sixth in the world, also experienced strong growth.

"Although there was an element of pent-up demand that fueled market growth, it was mainly the array of heavy promotions and discounts that accelerated growth in these markets," said Nabila Popal, research director with IDC's Worldwide Mobile Device Trackers. "In India, distance learning has boosted the demand for low-end smartphones as they are a more affordable option compared to tablets. The increased low-end demand only further increases competition and adds pressure to the vendors' bottom line."

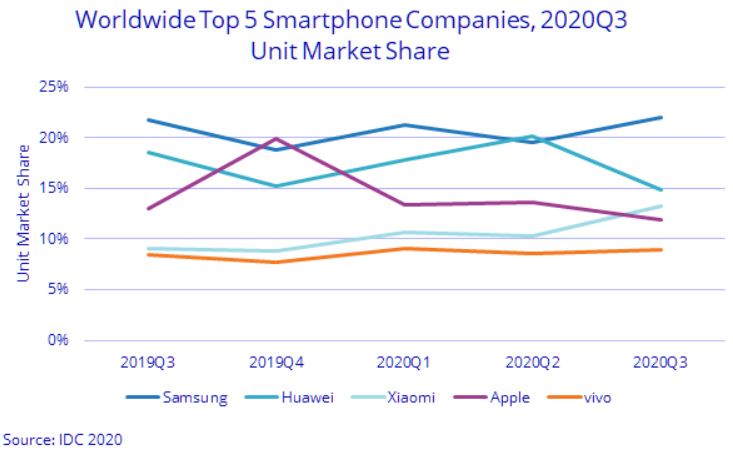

Larger, more developed markets like China, Western Europe, and North America all witnessed the largest declines in the third quarter.

Given these are the largest markets for Apple, the month delay in the iPhone 12 launch contributed to the decline. However, across many of these markets, 5G promotions are starting to heat up and a full array of products is quickly becoming available to consumers at all price points.

"While some of the topline numbers may not seem pretty, we are seeing a lot of improvement in the smartphone market both in terms of supply chains and consumer demand," said Ryan Reith, program vice president with IDC's Worldwide Mobile Device Trackers.

"In the large developed markets, it is very clear that 5G will be positioned to most consumers as their next phone regardless of which brand or price point they are focused on. Marketing has ramped up significantly. Products are widely available. Promotions are happening. And the top sales initiative in these markets is to push 5G. Having said this, we still believe consumer demand for 5G is minimal at best, which only adds to the price pressure on channels and OEMs."

No comments :

Post a Comment