By Geoff Iyatse

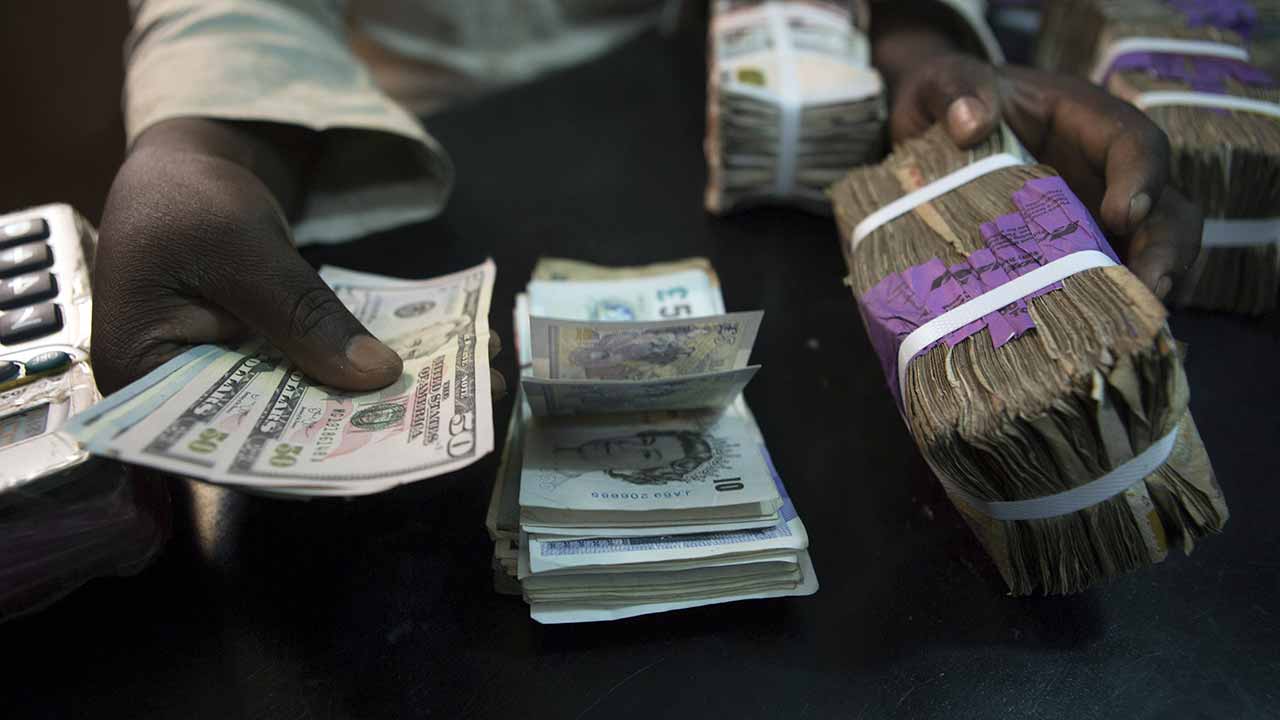

The parallel market has responded to the fresh devaluation of the naira amidst growing foreign exchange illiquidity. The local currency weakened to N500/$ at the black market at the weekend.

The Central Bank of Nigeria (CBN) had adjusted the value of the naira by N6 against the dollar on Friday. That was the third time the naira would be officially devalued this year.

In a weekly exchange rate for disbursement of proceeds of International Money Transfer Service Operators (IMTOs) issued on Friday, market dealers, including bureau de change (BDC) players and service providers were advised to add N6 to existing rates.

IMTOs sale of dollar to banks is pegged at N388 to a dollar, N6 higher than the previous N382 to dollar rate while banks sale of dollar to CBN was increased from N383/$ to N389/$.

CBN would henceforth sell dollar to BDCs at N390/$dollar instead of the previous N384/$ while BDCs are to sell N392/$ to end-users. They were previously selling at N386/$dollar.

In the circular signed, the Director (Trade and Exchange Department) of the apex bank, O.S Nnaji, said the rates would apply to disbursement from Monday, November 30, to Friday, December 4, 2020.

“Weekly Exchange Rate for Disbursement of Proceeds of International Money Transfer Service Operators’ pegged IMTOs sale of dollar to banks at N388 to dollar; banks sale of dollar to CBN at N389 to dollar and CBN sale of dollar to BDCs at N390 to dollar.

“The BDCs are now expected to sale to end-users at not more than N392 to dollar and each BDC is entitled to buy $10,000 weekly,” the circular read.

However, figures on the CBN’s website show that the apex bank’s

official rate remained at N379.5/$ at the close of trading last week.

Governor of the CBN, Godwin Emefiele, had at the 55th Bankers’ Dinner

held in Lagos on Friday assured that the country would be able to

stabilize the naira on the strength of the size of the reserves.

“Our external reserves,” he stressed,

“currently stand above $35bn and are sufficient to cover seven months of import.”

The Guardian reported last week that the pressure on the naira at the parallel market was not retreating despite the assurances by the Central Bank. At the weekend, parallel market operators insisted that demand continued to rise amidst growing illiquidity.

“With the devaluation news, many people with dollars are not willing to sell. So, we are in short supply; and the demand continues to rise. It is a double tragedy,” the operator said.

As of Friday also, the pound was officially trading at N505.6 while the euro was pegged at N451.6.

The President, Association of Bureaux De Change Operators of Nigeria (ABCON), Alhaji Aminu Gwadabe, had blamed speculators for the persistent crisis in the market. He warned that they would lose money except they stop the anti-market tendencies.

Also, Chief Consultant of B. Adedipe Associates, Biodun Adedipe, attributed the lingering currency crisis to blind speculation, auguring that there was no empirical evidence showing that the market was facing a serious challenge.

“I am not worried about what is happening in the market. This is not an election year, so nobody can attribute what is happening to the activities of politicians,” the economist said.

No comments :

Post a Comment