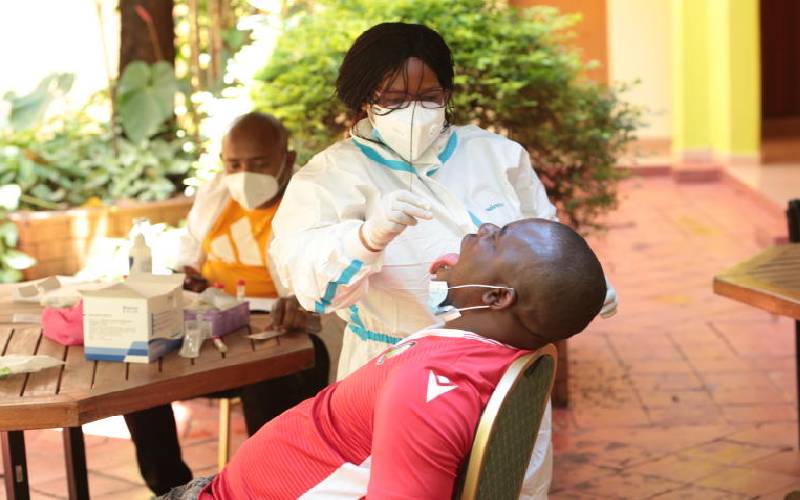

Kenya U20 players and coaches undergo Covid-19 testing. Kenya has taken a loan from the International Monetary Fund to combat the adverse effects of Covid-19. [Standard Sports]

Kenya is among the top five countries in the world that have tapped into the International Monetary Fund’s (IMF) credit facilities to help combat the adverse effects of Covid-19.

Analysis of the latest data from the IMF shows that by end of May, Kenya had outstanding loans of Sh104.9 billion, behind Ghana, Cote d’Ivoire and Bangladesh.

“For the IMF’s emergency financing to help countries address Covid-19, the right safeguards help balance the need to ensure that the funds reach those who need them most with the need to disburse them quickly,” said IMF in its annual report.

The report noted that the borrowing nations have to commit to undertake and publish independent ex-post audits of crisis-related spending. They also have to publish crisis-related procurement contracts on the State’s website, including identifying the firms awarded the contracts and their beneficial owners.

Ghana has the most outstanding loans at Sh264.8 billion, Cote d’Ivoire (Sh188.7 billion), Bangladesh (Sh133.6 billion) and.

In May, the IMF’s Executive Board, the highest decision-making organ, approved a loan of Sh75 billion ($739 million) through the rapid credit facility (RCF). The money was to help Kenya tackle the negative effects of Covid-19, including helping with the balance of payments as the Shilling came under pressure due to capital flight and reduced tourist inflows.

IMF noted that the impact of the virus on the Kenyan economy was expected to be severe. “The RCF will help the authorities to address those needs. It will allow them to maintain an adequate level of international reserves and help provide the budget financing needed to respond to the pandemic,” said the IMF in a statement.

This was the first time Kenya was tapping this credit facility. Tao Zhang, the IMF deputy managing director and acting chair stated the pandemic had impacted nearly all facets of the economy — particularly tourism, transport, and trade — and led to urgent balance of payments and fiscal financing needs.

“Emergency financing under the RCF will deliver liquidity support to help Kenya cover its balance of payments gap this year. It will provide much-needed resources for fiscal interventions to safeguard public health and support households and firms affected by the crisis,” Tao said.

This news comes at a time when there are reports that Kenya has approached the IMF for yet another loan in what is likely to increase outstanding loans at the Fund.

Besides IMF, Kenya has also borrowed over Sh100 billion from the World Bank for budgetary support, including the Big Four Agenda as well as strengthening the country’s health systems.

No comments :

Post a Comment