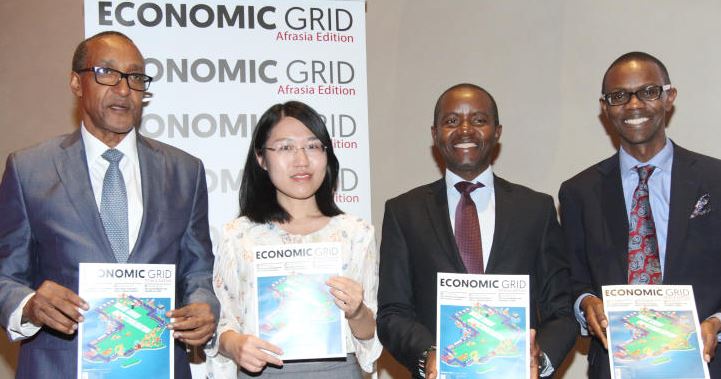

Foreign Affairs PS Ambassador Kamau Macharia (from left) Liu Yue (Chinese Embassy), ICT CS Joe Mucheru and Dr Gilbert Sagia during the launch of teh Econmic Grid at the Aspire Centre ,Westlands, Nairobi. Economic Grid is a global movement that aims to speed up the growth in technological and economic innovations. [Elvis Ogina.Standard]

Kenya is staring at a major drop in the amount of money investors pump into the country in new and continuing projects.

This as Covid-19 pandemic forces foreign firms to slow down on investments owing to the uncertainty caused by the deadly disease.

A new report by the United Nations Conference on Trade and Development (Unctad) said due to the uncertainties caused by Covid-19, companies held onto their money and slowed down on investments over the first half of this year.

The UN agency expects this trend to continue for the remainder of the year, with Foreign Direct Investments inflows predicted to decline by up to 40 per cent.

It will be the second year in a row for Kenya to register a decline in FDI after going down 23 per cent last year.

“Global FDI flows in the first half of 2020 were under severe pressure due to Covid-19 pandemic. They reached an estimated $399 billion (Sh43 trillion), 49 per cent less than in 49 less than in 2019, as lockdowns around the world forced companies to delay existing investments projects and to postpone non-essential investments to preserve cash buffers,” said Unctad in its latest Investment Trends Monitor Report published Tuesday.

This will mean another bad year for Kenya in terms of foreign inflows following a substantial decline last year.

According to data by the Kenya National Bureau of Statistics (Knbs), net inflows of foreign direct investments declined by 22.3 per cent to Sh115.1 billion last year.

The drop was despite several major investments in ICT and healthcare.

Over the first six months of the year, the report notes, FDI inflows to African countries dropped by 28 per cent to $16 billion (Sh1.7 trillion).

“Greenfield project announcements fell by 66 per cent and cross border mergers and acquisitions by 44 per cent,” said the report.

Unctad had in June this year projected a decline of 30–40 per cent in FDI inflows this year. It notes that the performance in the first half largely remains in line within the projections.

“Projects for 2020 remain laden with uncertainty. With a second wave of the pandemic in some developed economies undermining efforts to return to normal, the near 50 per cent decline in first half of 2020 could persist longer,” said Unctad.

Morocco and South Africa are the only countries on the continent which recorded growth in FDI flows, with Morocco’s growing six per cent to $0.8 million (Sh86 billion), which Unctad attributed to a relatively diverse investment profile. South Africa’s FDI inflows increased by 24 per cent to $2.9 billion (Sh313 billion).

No comments :

Post a Comment