By

Fredrick Obura

By

Fredrick Obura

NAIROBI, KENYA: The East African region needs at least 60 footwear factories to meet the growing demand for shoes in the region.

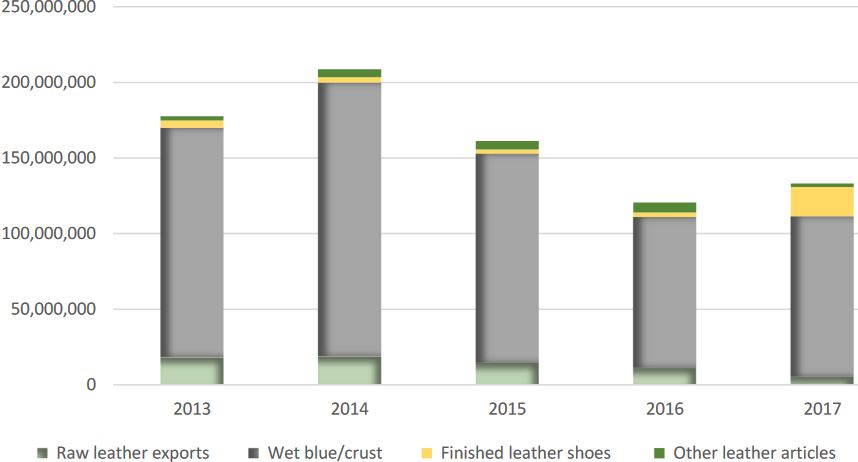

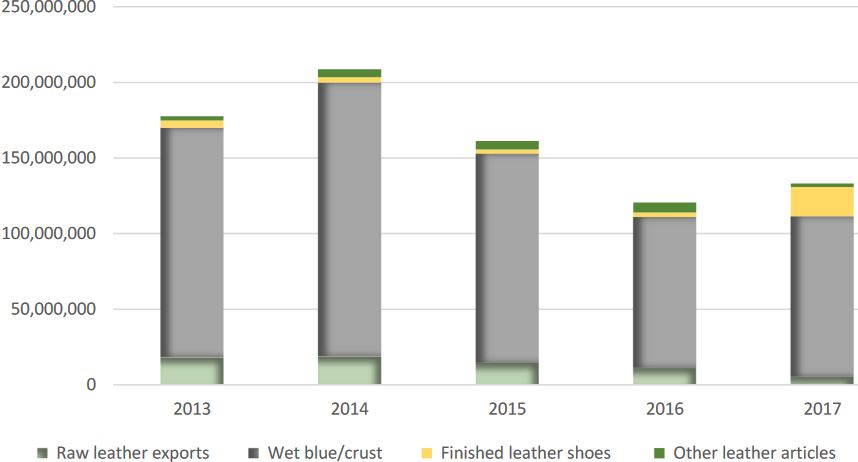

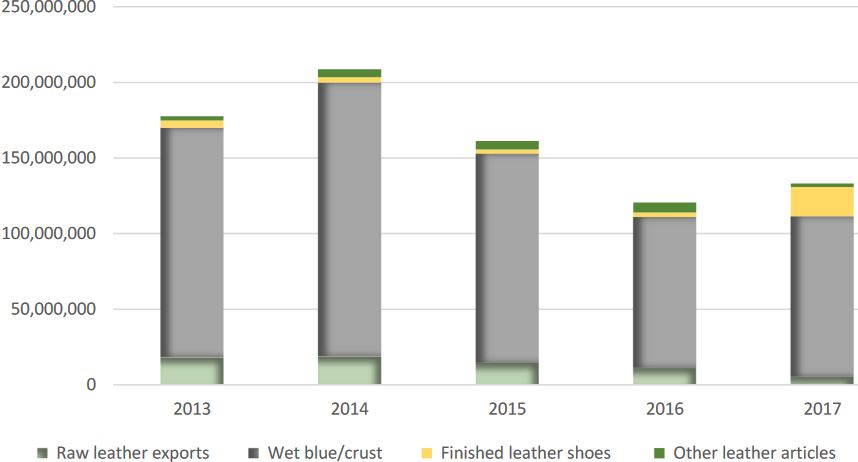

A regional value chain paper for the leather industry by the East African Business Council (EABC) documents a number of challenges and areas of improvement to unlock the multi-billion industry.

The industry plays a major role in the global economy, with an estimated global trade value of approximately Sh10.8 trillion ($100 billion) per year, which is greater than the combined value chain of meat, sugar, coffee, and tea.

According to the regional body, the East African Community (EAC) currently has a monthly demand of about 600,000 pairs of industrial shoes. It puts current production at only about 60,000 shoes per month which presents an opportunity for the private sector to set up 60 shoe factories in the region to meet the regional demand of 600,000 pairs of shoes per month.

Kenya’s leather industry, compared to her EAC peers, is relatively more diversified against a comparable size of livestock endowment.

As of 2009, the livestock census counted a cattle population of approximately 17.5million (including exotic breeds), 17.1 million sheep, 27.7 million goats and2.9 million camels.

Between 2012 and 2016, Kenya slaughtered, per annum, an average of 2.3 million cattle and 6.58 million sheep and goats.

According to the Kenya Leather Council, there are 15 registered tanneries in Kenya, Alpharama being the biggest. There are relatively high levels of capacity utilization in the tannery industry, ranging between 70 and 85 per cent, mostly for wet-blue.

Seven of the 15 registered tanneries produce finished leather. The value chain is relatively nascent with some level of interconnectedness; for example, smaller tanneries like Dogbones supply wet blue to Alpharama.

Kenya’s leather wholesale value-chain segment is somewhat better developed compared to her EAC peers. Companies like Dismas Leather Stores and Dimu Leather Shop, buy leather in bulk from the large tanneries and then supply it to a myriad of small industry manufacturers.

Large-scale producers of finished footwear products like Bata, and Leather Masters, dominate the finished leather value-chain segment. A relatively small export sector of high-value high-quality leather from Kenya to Europe, North America and Asia, exists.

Rwanda and Burundi which are both relatively smaller markets have an estimated demand for finished leather footwear of approximately 8 million pairs and 7 million pairs respectively, with an effective demand of between 30 and 35 per cent for both countries.

Rwanda has moved to ban the importation of used footwear.

“It is evident that across the EAC, demand for leather and leather products is growing much faster than supply, there is growing competition from low-cost sources of leather and leather products like China and India, against a relatively stagnant level of competitiveness of the EAC leather industry, the level of branding in the industry is very young and almost non-existent and that across the EAC, high-quality skills are in very short supply,” notes the study.

To promote the industry EABC recommends among other measures financing, access to technology and skills, scrapping of taxes to hides, and skins across the region (EAC).

“Intra-regional trade in leather products and especially footwear is promising and with huge potential, to substitute imports from Asia and Europe, if complementary policies such as a gradual phase-out of second-hand leather shoes, and promoting local sourcing i.e.“Buy East Africa Build East Africa” campaigns) and technological and skills capability are reinforced.”

No comments :

Post a Comment