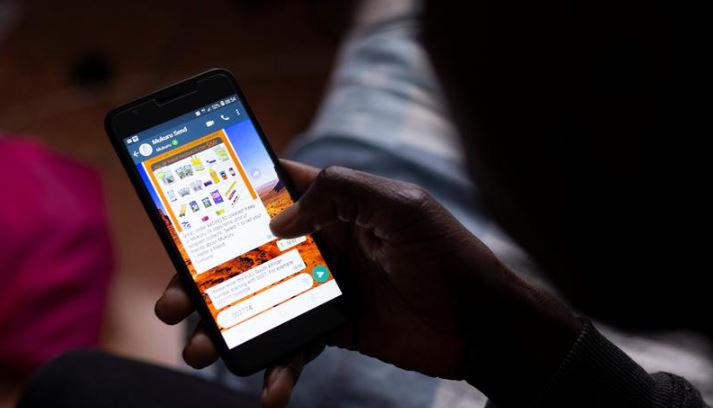

Brighton Takawira uses the Mukuru remittance app

which enables him to send money and groceries home to family in Zimbabwe

from his home in Pinetown, South Africa, October 21, 2020. Picture

taken October 21, 2020. [Reuters]

Brighton Takawira uses the Mukuru remittance app

which enables him to send money and groceries home to family in Zimbabwe

from his home in Pinetown, South Africa, October 21, 2020. Picture

taken October 21, 2020. [Reuters]

Then the pandemic struck. Borders closed. The buses he had used to send his cash stopped running.

“I had to send something, even a few dollars,” said Takawira, though it meant sometimes going without bread. So he tried out an online remittance company on a friend’s recommendation.

He is one of many African migrants being pushed towards digital transfer services, often for the first time, during the pandemic.

This is fueling a boom for Africa-focused money transfer companies, despite predictions from the World Bank of a historic 20 per cent drop to USD445 billion in remittances to poorer countries this year due to a pandemic-induced global economic slump.

“We saw an increase of transfers as the diaspora wanted to help their family,” said Patrick Roussel, who heads mobile financial services for the Middle East and Africa at French telecom company Orange - a dominant player in French-speaking Africa.

Like Takawira, many had to dip into savings or make other sacrifices to do so, analysts and company officials say.

The pandemic gave remittance companies an advantage over their main competition in Africa: the sprawling informal networks of traders, bus drivers and travellers used by many migrants to send money home.

“We’ve seen an influx of new customers, and we see them mainly coming to us from the informal market,” said Andy Jury, chief executive of Mukuru, the company Takawira now uses.

Jury and other industry executives say that shift is likely to last as digital remittance services are typically cheaper, faster and safer than informal networks, which are difficult for governments to regulate.

Mukuru, which focuses mainly on African remittances and allows customers to send both cash and groceries, has seen a roughly 75 per cent acceleration in growth compared to last year.

‘Silver Lining’

Remittances to sub-Saharan Africa officially totalled USD48 billion last year, according to the World Bank. Experts, however, say that figure tells only part of the story.

Much of the money Africans ship home via informal networks is absent from official data.

As those networks ground to a halt during lockdowns, formal money transfer businesses - particularly digital platforms - were suddenly the only game in town.

According to Kenyan central bank data, remittances to Kenya were up 6.5 per cent though August compared to the same period last year. Remittance inflows to Zimbabwe were up 33 per cent through July.

Online remittance company WorldRemit reported last week that transfers to Zimbabwe via its service had doubled over the past six months.

Azimo, a UK-headquartered remittance company whose major African markets include Nigeria, Ghana and Kenya, saw a nearly 200 per cent increase over the expected number of new customers in April, May and June.

“I’d swap it out for no pandemic any day of the week,” Azimo CEO Michael Kent told Reuters. “But given that’s what’s happening, I think you are seeing digital adoption in financial services all over the place.”

Remittance companies got an additional boost early on in the pandemic when African central banks reduced fees and loosened limits on digital transactions, to encourage the public to use digital services to facilitate social distancing.

“I would probably agree with the World Bank that the total amount (of remittances) will go down,” said Dare Okoudjou, founder of MFS Africa. “But anyone who’s in digital would actually gain market share and see their volume go up.”

The company, which runs networks across 36 African countries to channel remittances between mobile money accounts, has seen year-on-year transaction growth of over 90 per cent in 2020.

The industry is now at an inflection point, analysts say.

“If we can get the money flowing with less friction, it’s going to be better for everybody. That’s the silver lining,” said Timothy Ogden, managing director of the Financial Access Initiative at New York University.

Takawira, whose brother also works in South Africa, says he’s now using Mukuru each month to send cash and groceries to his 60-year-old mother in rural Zimbabwe, where inflation is topping 650 per cent.

“My salary does not buy much ... When the boys send me money, it does help a lot,” his mother Gladys Muzira told Reuters.

No comments :

Post a Comment