The company, which comprises of CIC Life Assurance Limited, CIC General Insurance Limited, CIC

Asset Management Limited, and Takaful Insurance Limited, initially canceled the AGM citing ‘new developments’ that required shareholder’s approvals.

The AGM was to be held on 30 June 2020.

In a notice the shareholders, the Group says registration for the AGM opens on 7 Sept. and closes 27Sept 2020 at 5.00 pm.

The Nairobi Securities Exchange-listed firm in its full-year 2019 financial results saw it post Ksh 386 million profit before tax, a decline from Ksh 645 million in 2018.

“This was mainly due to higher year on year growth in claims expenses and flat growth in net earned premiums,” the Group said in its annual report.

The Group’s total assets grew to Ksh 35.3 billion from 33 billion in 2018.

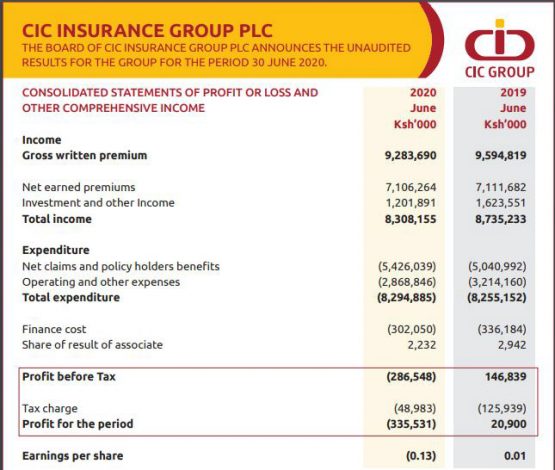

The company made a KSh335.5 million net loss in the half-year ended June compared to a net profit of KSh20.9 million in 2019.

Claims rose to KSh5.4 billion. Its net premiums were flat at KSh7.1 billion. Operating expenses declined 10.7 percent to KSh2.8 billion. Finance costs declined 10.1 percent to KSh302 million.

The Group operates in South Sudan, Malawi, and Uganda, underwriting general insurance and life insurance.

READ

No comments :

Post a Comment