Nume Ekeghe

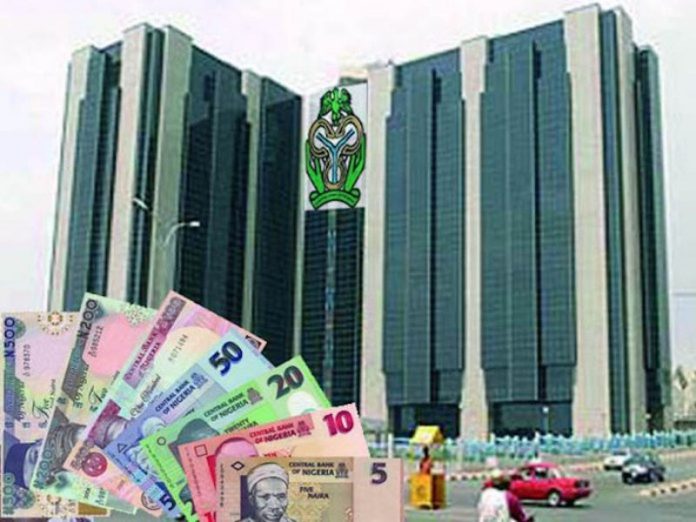

The Central Bank of Nigeria (CBN)

yesterday directed merchant acquirers and other operators in the...

payment

system to take steps towards enhancing pre-authorisation and

sales-completion of card transactions in the country.

According to the CBN, the directive

became necessary because it had identified the predominant use of single

messaging format for PoS transactions as an obstacle to the use of

pre-authorisation as a mode of payment in Nigeria.

The banking sector regulator disclosed

these in a circular posted on its website, that was signed by its

Director, Payment System Management Department, Mr. Musa Jimoh, a copy

of which was posted on its website.

In line with this, it directed all

merchant acquirers to obtain Acquirer Device Validation Certification or

the applicable testing completion notification from the CBN-licenced

card schemes.

According to the Bank, by the directive,

all PoS terminal must have the capability for transaction

pre-authorisation and sales completion.

Also, PTSA (NIBSS) are to ensure that

only banks that have conducted and obtained PoS terminal validation

certificate for pre-authorisation and sales-completion from the relevant

card schemes, have their PoS terminals registered on the Central

Terminal Management System.

“All card issuers are required to build

the capability and enable the processes for pre-authorisation and

sales-completion of transactions.

“Card schemes are also required to

provide online simulators for acquirers and issuers to test their

systems, when necessary,” it added.

The central bank stressed that the

circular takes immediate effect, but with a deadline of July 31, 2020,

for full compliance, after which appropriate sanctions would be imposed

for contraventions and non-compliance.

It explained that the move was part of

its commitment to facilitate the development of the Nigerian payment

system and deepen the adoption of various electronic payment options

available to users.

No comments :

Post a Comment