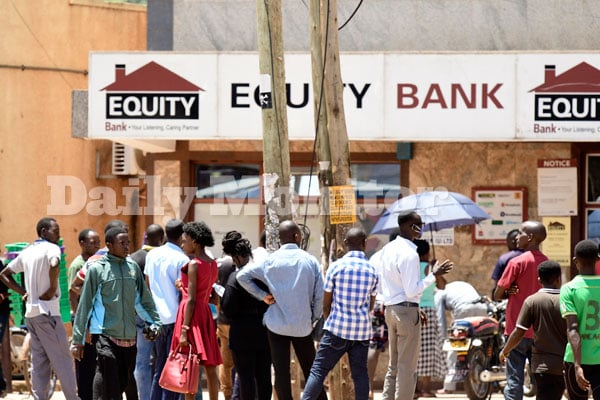

People line up to withdraw money at an Equity Bank ATM at Kabalagala along Ggaba road in Kampala, Uganda. PHOTO | DAILY MONITOR | NMG

Ugandan police have arrested Equity Bank Uganda's former Executive Director for Commercial Banking, Kenneth Onyango, in connection to ongoing investigations into alleged stock loans and agent float financing fraud.

Sources told the Daily Monitor late Thursday that Mr Onyango was taken into custody on orders from the Directorate of Public Prosecutions (DPP).

“He is being investigated in line with that case [fraud]. It’s true he is in police custody. DPP will guide on the next course of action,” a source told Monitor.

Images of a handcuffed Onyango, who reportedly resigned from the bank last month, were shared on various social media platforms Thursday evening.

Equity is reported to have accepted his resignation with “immediate effect”, subject to the outcomes of investigations, which by then were underway.

Read: EA businesses pay the price for ignoring fraud controls

The Daily Monitor understands that he was arrested by Kampala Metropolitan Police whose spokesperson, Patrick Onyango, declined to speak on the matter.

Police are expected to issue a formal statement on the arrest on Friday.

Equity Bank Uganda on Thursday said it would not comment on the arrest since the investigations were ongoing by state law enforcement and any disclosures could jeopardise the inquiries.

The bank, however, referred the Monitor to its March 7, 2024, statement on “possible fraud on our stock loan and agent financing products” when news of the scandal first broke.

“People of interest, including a few of our staff and customers, are currently assisting with investigations by the relevant law enforcement authorities,” the unsigned statement reads.

It added: “We hold ourselves to the highest standards of accountability and transparency, and a person found to be responsible, whether through fraud or errors of commission or omission, will be fully addressed in accordance with the policies, procedures and ethical values of the organisation and, where appropriate, the laws of the country.”

A fortnight after the bank’s statement, five former Equity Bank employees were on March 20 charged at the Anti-Corruption Magistrate’s Court with obtaining credit by false pretence, money laundering, and conspiracy to defraud.

Read: Equity staff under probe for alleged $16m loans fraud

They are Julius Musiimenta, the head of agency banking; Erina Nabisubi, the relationship manager telecoms; Fred Semwogerere, a banker; Crescent Tumuhimbise, a relationship officer; and Wyclif Asiimwe, a distribution and marketing consultant.

They did not take plea and were remanded to prison after the presiding magistrate said the allegations included capital offence triable by the High Court.

Police last week revealed that they had taken into custody two more suspects in relation to the case. A source familiar with the investigations said Thursday night that Mr Onyango was arrested alongside three agent banking operators.

This followed findings by investigators that the fraud was occasioned mainly through alleged complicity between some Equity Bank staff and specific operators of agent banking categorised as “super agents” because of their high net business value.

Following the revelations, the Daily Monitor understands that the Bank of Uganda has ordered forensic audit into the bank amid assurances that depositors’ money is safe and there is no need to panic.

The amount reported lost through the alleged money laundering and fraud scheme is $16 million (Ush62 billion), most of it disbursed as unsecured loans to unqualified persons.

Mr Onyango worked with the bank in various capacities -- over time heading its risk, operations and business portfolios before he was elevated to superintend commercial banking.

No comments :

Post a Comment