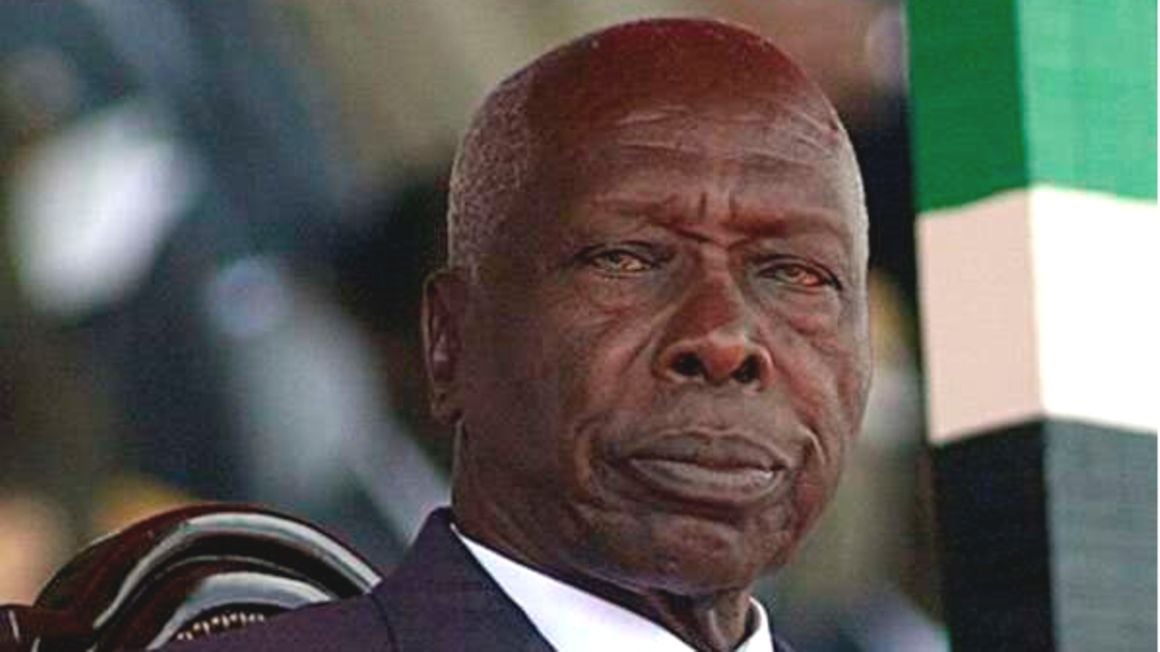

Late President Daniel arap Moi. FILE PHOTO | NMG

Parliament has two months to determine whether the estates of the late founding President Jomo Kenyatta and his successor Daniel Arap Moi will be subject to the

Estate Duty Act.This is after four Kenyans petitioned the National Assembly to amend section 7(3) of the Estate Duty Act, CAP 483 of 1963 which exempts the property of Mr Kenyatta and Mr Moi from paying estate duty.

Read: Moi leaves family with Sh5.1bn bill for land wrangles

The said section stipulates that whenever any person dies, a tax known as estate duty shall be imposed and paid on all property on which the deceased (person) was at the time of his death competent to dispose.

The Act, enacted in 1969, stipulates that section 7(3) “shall not apply to His Excellency Mzee Jomo Kenyatta, nor His Excellency Daniel Toroitich arap Moi.”

The law was further amended in 1981 after the death of Mzee Kenyatta to specifically accommodate Mr Moi.

Godfrey Maina, Kevin Kiarie, and Mugo Wangai have filed a petition to amend the Act to entrench equality in taxation.

“Section 7(3) exempts the estate of Mzee Jomo Kenyatta and Daniel Arap Moi, both retired Presidents from imposition from estate duty,” they said in a petition read to MPs by Speaker Moses Wetangula.

“The petitioners indicate the section is contrary to the provisions of the Constitution that provides that no law may exempt state officers from paying taxes.”

Mr Wetangula directed the National Assembly’s committee on Public Petitions to consider and report the findings to the petitioners and the House within 60 days.

Also read: Bid to halt sharing of Moi's wealth flops

The petition follows a similar attempt by Nandi Senator Samson Cherargei who has drafted a Bill seeking to repeal the same section that exempts Mr Kenyatta and Mr Moi, both deceased from payment of estate duty on their vast properties.

Mr Charargei has accused the families of former Presidents Kenyatta and Moi of evading taxes through the provisions of the law.

→emutai@ke.nationmedia.com

No comments:

Post a Comment