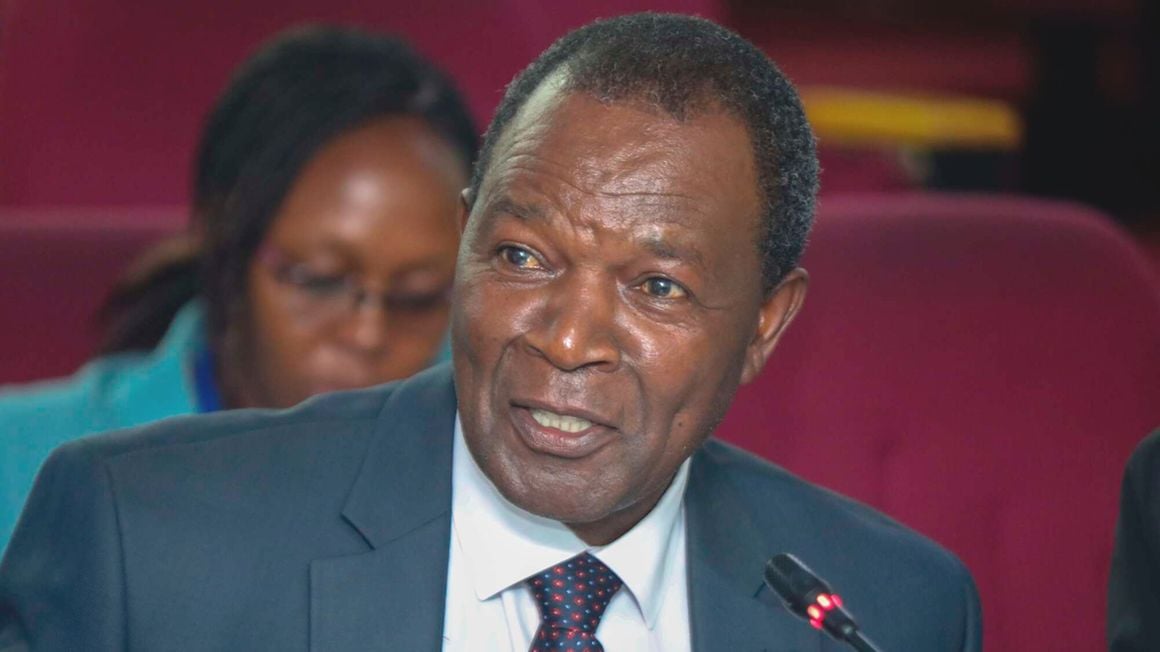

Cabinet Secretary for National Treasury and Economic Planning Prof Njuguna Ndung'u before the Committee on County Public Investments and Special Funds at KICC, Nairobi on April 24, 2023. PHOTO | DENNIS ONSONGO | NMG

The Treasury has attributed Sh231.54 billion in savings on debt repayments budget to a slower-than-projected depreciation of the shilling and increased tapping of

concessional external loans amidst reduced domestic borrowing.The William Ruto administration spent Sh1.16 trillion on servicing debt owed to foreign and domestic creditors in the financial year ended June, official data shows, 16.62 percent lower than what had been budgeted by the predecessor regime.

“The public debt service costs dropped on account of lower than projected borrowing, exchange rate and interest rates on new borrowing,” Dr Haron Sirima, the director-general for the Public Debt Management Office (PDMO) at the Treasury, said.

The shilling lost 19.48 percent of its value against the US dollar in the review year, according to official exchange rate data published by the Central Bank of Kenya (CBK).

Treasury had, however, projected a higher weakening of the shilling in the period when budgeting for servicing external debt.

Read: Debt costs eat up 63.5pc of taxes in two months

Dr Sirima did not disclose the forecast exchange rate for the year under review.

A weakening shilling against the dollar raises spending on foreign debt because about two-thirds of the country’s external debt is denominated in the US currency.

The shilling was under persistent pressure from the dollar in the second half of the year on higher demand than supply of the greenback, defying a foreign exchange code by the CBK and a government-backed deal to import fuel from Saudi Arabia and the United Arab Emirates on credit.

The savings also came in a year domestic creditors such as banks and insurers baulked at the interest rates offered by the CBK, the government’s fiscal agent, holding out for higher returns.

The underperformance in Treasury bonds and bills resulted in a Sh344.06 billion shortfall in domestic borrowing, including debt rollovers.

That was after the Treasury mobilised Sh696.40 billion against the original target of Sh1.04 trillion.

The PDMO says it substituted part of the short-term debt (T-bills) it had planned to tap locally with long-term external borrowing.

Foreign borrowing, including grants, amounted to Sh488.31 billion against an initial goal of Sh349.33 billion despite the Treasury, for the second year in a row, shelving a plan to borrow from international capital markets — Eurobond— because of elevated interest rates.

Read: Weak shilling, global rate rises cost Kenya Sh27bn

Kenya, instead, tapped more concessional loans from multilateral institutions, largely the International Monetary Fund and the World Bank Group than it had planned in the original budget.

→ cmunda@ke.nationmedia.com

No comments:

Post a Comment