Real-time bank transfers and cash transactions at mobile money agents declined by

over Sh90 billion in February pointing to the slowed business activity in the month when spending was constrained on cash flow woes.The value of the deals, which had been rising in previous months, are an indicator of the investment and consumption trends in an economy.

Transactions cleared and settled through the Kenya Electronic Payments and Settlement System and Real Time Gross Payment System (KEPSS/RTGS) declined by Sh79.8 billion to Sh3.1 trillion in February compared to the previous month, according to the Central Bank of Kenya data.

This was the first month when businesses reported a contraction in activities, including investments, since August last year.

CBK requires banks to strictly process and settle payments above Sh1 million through the real-time RTGS/ KEPSS system where cash reflects within four hours of getting instructions under guidelines enforced from October 2009.

The fall in transactions by companies and high-net-worth households was also reflected in purchases through point-of-sale (POS) machines, which dropped by Sh2.6 billion to Sh19.4 billion in the same month under review.

This comes after Stanbic Bank Kenya’s Purchasing Managers Index (PMI) pointed to a decline in business conditions in February.

For the first time in six months, the headline PMI registered below the 50.0 no-change mark in February, dropping to 46.6 from an 11-month high of 52.0 in January amid a sharp fall in production and new orders, leading to renewed cuts in employment and purchasing.

The shilling weakness against the US dollar led to higher input and import costs with businesses passing this, including tax burdens on to customers.

“The Kenya PMI fell into contraction territory in February as cash flow issues and cost of living weighed on demand. With currency depreciation inducing higher import costs and reports of tax burdens, the increase in input costs and consequently output charges is amongst the highest since the series began in 2014,” said Mulalo Madula, Economist at Standard Bank.

“The sharp fall in sales came amid reports that cost-of-living pressures and cash flow problems had stunted customer spending,” Stanbic PMI stated.

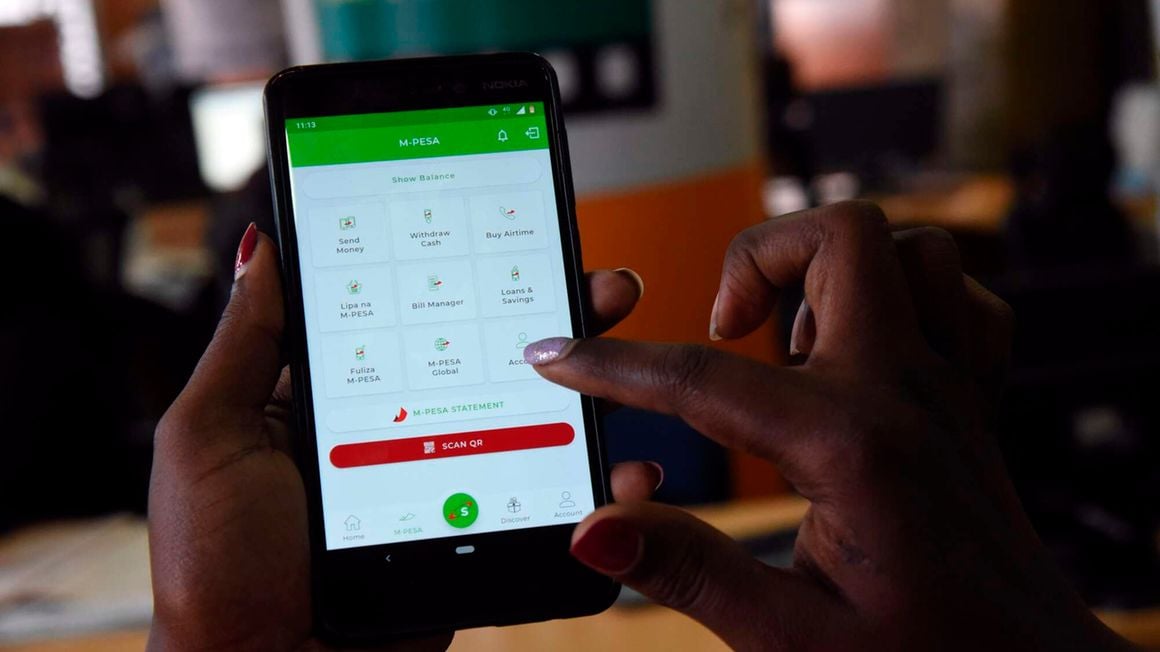

Cash handled by mobile money agents also declined amid high inflation that has cut consumers’ buying power.

The value of deposits and withdrawals at mobile money agents in February dropped by Sh11.2 billion to Sh578.1 billion from Sh589.3 billion in January.

The value of cheque payments, which are capped at Sh1 million per transaction, bucked the trend to register an increase.

The CBK data shows that the value of paper-based payments rose by Sh5.86 billion to Sh212.4 billion in February.

→ ekivuva@ke.nationmedia.com

No comments:

Post a Comment