by

-

Insiders sometimes open their wallets when shares are cheap

-

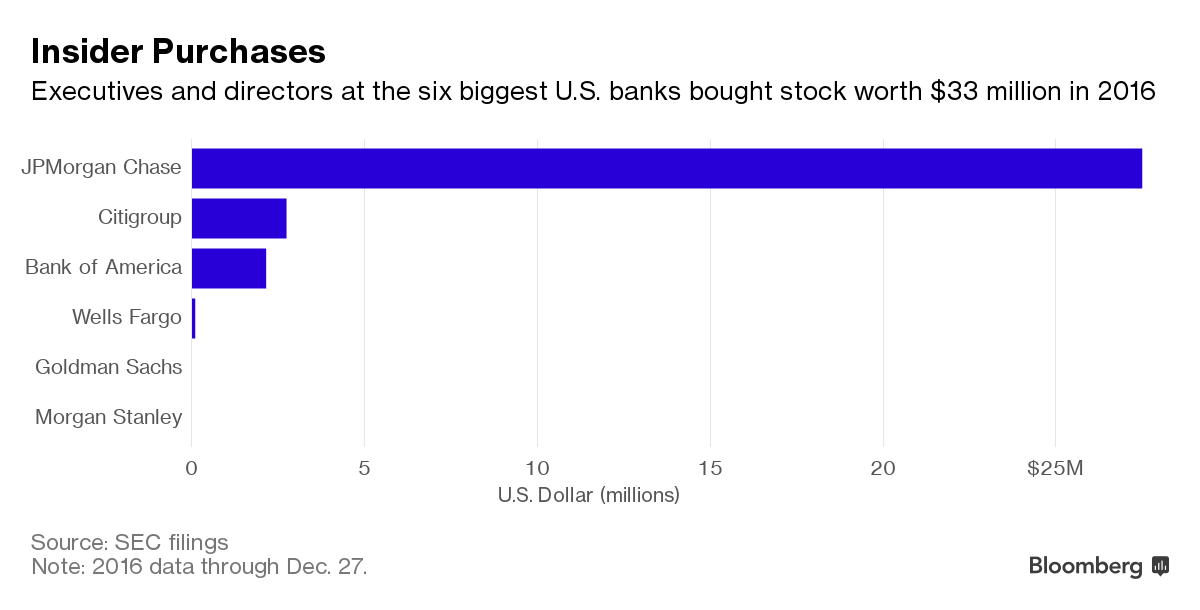

JPMorgan chief spent $26 million on his bank’s stock this year

Photographer: Laura McDermott/Bloomberg

Insiders at a majority of S&P 500 Index companies didn’t purchase any of their firm’s shares in the open

market this year, according to data compiled by Bloomberg, a far cry from the $26.6 million Dimon shelled out for JPMorgan Chase & Co. equity.

Most corporate executives and directors steered clear as U.S. stocks became increasingly expensive. A rally since the presidential election has lifted equity indexes to records and the S&P 500’s price-to-earnings ratio to a seven-year high.

Another consideration that probably matters more than share prices: Top bosses at U.S. companies typically don’t need to buy stock because they acquire considerable ownership by receiving the bulk of their multimillion-dollar pay packages in stock.

“If you work at a butcher and a significant benefit of the job is that you get to take home several steaks every week, why would you want to buy more steak?” said Ian Levin, a partner at Schulte Roth & Zabel focused on executive compensation.

Pessina’s Buy

The insider data compiled by Bloomberg tallied open market purchases this year through Dec. 27 disclosed in regulatory filings by named executive officers, directors and beneficial owners of more than 10 percent of any class of a company’s shares.Wealth managers often discourage executives from acquiring more shares in their employers and instead advise them to diversify. Not everyone listens. Open-market purchases can be a way for an executive to publicly demonstrate faith in the stock and signal that it’s undervalued. Also, some purchases can stem from ownership requirements stipulated by the board.

At six of the 10 companies with the most insider buys this year, the chief executive was the single biggest purchaser. Walgreens Boots Alliance Inc. CEO Stefano Pessina spent $162.8 million on shares this year, equal to more than 99 percent of total insider purchases, regulatory filings show. Director John Lederer was responsible for the remaining $810,000.

Steve Wynn

Photographer: Calvin Sit/Bloomberg

Dimon bought 500,000 JPMorgan shares in February after the stock tumbled to the lowest price in more than two years. He believed the shares had become cheap, a person familiar with his thinking told Bloomberg at the time. His $26.6 million outlay comprises about 97 percent of JPMorgan insider purchases this year.

Multimillion-dollar purchases often amount to only a fraction of an executive’s total net worth. Pessina, Wynn and Dimon, for example, are all billionaires.

Insiders at the country’s six biggest banks bought very little stock in 2016. Those at Goldman Sachs Group Inc. and Morgan Stanley haven’t purchased a single share of stock in the open market this year through Dec. 27, according to data compiled by Bloomberg.

No comments:

Post a Comment